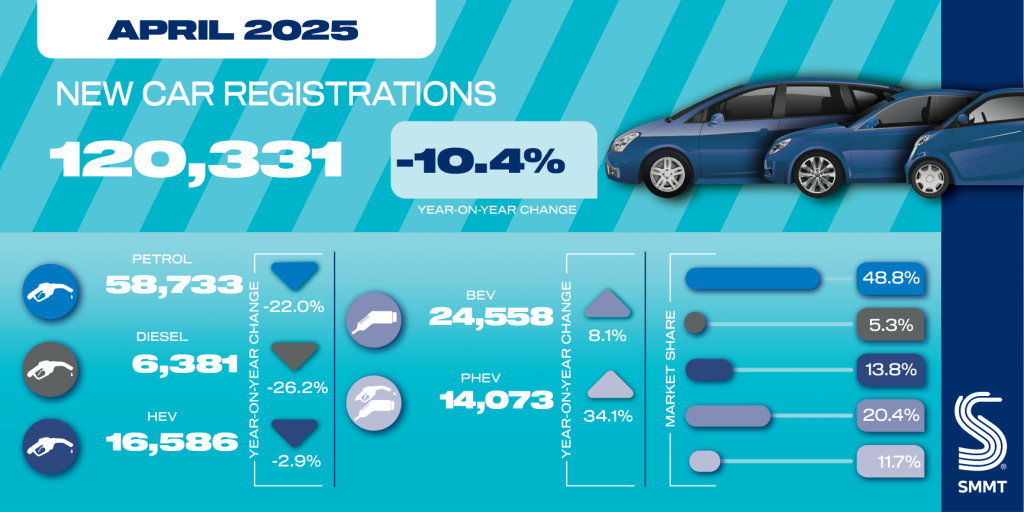

The UK’s new-car market suffered one of its worst results in recent years during April. The latest data from the SMMT shows registrations declined 10.4% in the month. However, there were a number of factors combining to cause a drop in deliveries.

The result is the sixth fall in registration figures in the last seven months. Only March saw a rise, due to the country’s new registration plate release. The immediate drop in April highlights the frailty of the country’s market, which was one of the strongest in Europe until recently.

April also represented the worst decline in registrations since June 2022, when the supply-chain crisis was impacting deliveries. Since then, there have only been eight monthly declines, as the market built itself back. Yet the dramatic drop last month indicates the potential struggles that lay ahead.

Changing UK legislation

April is often a quieter month for registrations in the UK, following on from the busy period in March. However, volumes were also impacted by the later Easter in 2025, which reduced working days compared to last year.

The month also saw the implementation of vehicle excise duty (VED) on battery-electric vehicles (BEVs). In addition, the Expensive Car Supplement on electric models costing over £40,000 also came into effect.

The implementation of VED on BEVs will add around £195 to the cost of new models each year, with this rate reduced to just £10 in year one. The ECS will see £425 added to the standard VED rate in years two to six of registration, increasing costs further.

This may have impacted consumer confidence in the electric vehicle (EV) market, which has been the strongest segment in recent months. With May offering a return to a normal working-day comparison, it will give a better indication of the impact of recent changes, especially in the BEV market.

Are BEVs faltering?

BEV registrations grew 8.1% in April, with 24,558 units taking to UK roads. While this is a positive outcome for the all-electric market, it is the lowest growth of the year to date. January, February and March all saw registrations improve by over 40%, indicating a significant drop in the market during April.

However, the rise did mean that BEVs took a 20.4% market share in the month, up by 3.5 percentage points compared with April 2024.

The sudden drop in BEV interest may be felt more in May. With registrations counting at the time of delivery, it remains to be seen whether there will be a further drop this month, which could result in a decline.

In the first four months of the year, the BEV market is up 35.2%, with 144,749 registrations. This equates to a 20.7% market share, an improvement of 5pp, but below the ZEV mandate target.

With this in mind, the SMMT has again called on the UK government to help boost the BEV market. It has suggested halving VAT on new EV purchases, scrapping or amending the ECS and equalising VAT on public charging to that levied on domestic options. By doing this, the body believes it will send a strong signal to hesitant buyers.

ICE drags market down

The struggles in the UK’s new-car market this year have occurred due to a sudden drop-off in petrol registrations. April was the worst month of the year so far, with a 22% decline in deliveries.

In total, 58,733 units took to UK roads, a drop of 16,601 deliveries. This is the 13th consecutive month of petrol declines, and the worst drop in that period. Even with MHEVs added into their figures, the powertrain is unable to improve its performance year on year.

This may be due to carmakers prioritising full hybrids (HEVs) and BEV models in their ranges, reducing availability of petrol models. However, it seems buyers are turning away from the market in favour of greener options.

Despite its poor performance, petrol still managed to dominate the market. Its share of 48.8%, however, was down by 7.3pp year on year.

Between January and April, petrol registrations declined 10%, with 345,520 units taking to the road. This gave the technology a 49.3% share of the total, a drop from the 56.5% recorded in the same period last year.

Meanwhile, diesel’s decline continued. The fuel type recorded 6,381 registrations in the month, down 26.2%. Its 5.3% market share was a drop of 1.1pp compared to April 2024, making it the worst-performing powertrain in the month.

Over the first four months of the year, diesel has seen deliveries decline 13.2%, with just 40,214 units registered. This gave the technology a 5.7% market share, down 1.1pp.

Combined, the ICE market fell 22.5% in April, equating to 18,869 fewer units. It still dominated, with a 54.1% share of the registrations total, although this is a drop of 8.4pp. In the year-to-date figures, ICE is down 10.3%, with a 55% market share, down 8.3pp.

What does this mean?

As seen in the recent motorparc figures, the UK’s car parc is continuing to grow, and age. Therefore, with petrol and diesel registrations declining, the market for used models will likely improve.

But in time, this market will also begin to struggle, due to lack of supply. Fewer new models means fewer used models in three-years time, the average age a vehicle enters the aftermarket.

Yet with the increase in car parc age, it seems that while drivers are not buying new petrol and diesel models, they are holding onto their cars. This is good news for workshops, as those cars will need servicing as they continue to age. Therefore, fewer ICE registrations is a positive move for the aftermarket.

Mixed results for hybrids

Plug-in hybrids (PHEVS) were the only other powertrain in April to record growth. The technology was up 34.1%, with 14,073 units delivered to customers. This gave PHEVs a 11.7% market share, up from 7.8% in April 2024.

In the first four months of the year, PHEVs have achieved consistent growth. This means that between January and April, the market improved by 27.7%, with 67,759 units delivered. This equated to a 9.7% market share, up 1.9pp.

However, HEVs, struggled, and recorded their first decline of the year. With a total of 16,586 registrations, figures were down 2.9% in the month. However, this was just a difference of 495 units compared to the same period last year.

This was the first drop in the HEV market since November 2024. As the UK does not include mild-hybrids in these figures, instead merging them into their respective petrol and diesel counterparts, it gives a good representation of the industry. In this respect, it is the electric vehicle (EV) market that is continuing to prop up the UK market, while other powertrain types suffer.

Despite the decline in registrations, HEVs actually improved their market share, by 1.1pp to 13.8%. This was mainly due to poor performances from other powertrains in the UK new-car market.

The HEV decline in April was not enough to impact the year-to-date results for the technology. Registrations over the first four months of the year are up 14.6%, with 102,591 units making their way to customers. This is a 14.6% share of the market, an increase of 1.4pp.

Electrified market poised to dominate

With the positive results for the BEV and PHEV markets, the EV sector saw an improvement of 16.3% in April. This was an increase of 5,421 units, and equated to a market share of 32.1%, up 7.4pp. Therefore, EVs made up nearly a third of UK new-car registrations in April.

Over the first four months of the year, the plug-in market is up 32.7%, with 52,425 more units taking to the road. The 30.3% share is an increase on the 23.5% recorded during the same period in 2024.

Adding HEVs into this mix, the electrified vehicle sector gained 9.8% more registrations last month, for a 45.9% market share. The technology has yet to capitalise on the decline of internal-combustion engine (ICE) registrations, although it is likely just a matter of time before it becomes the dominant segment of the industry.

In the year-to-date figures, electrified models are up by 26.2%, as 65,464 more new models were delivered to customers. This gives the market a 45% share of total registrations, up by 8.3pp against the same period last year.

You must be logged in to post a comment.