The UK’s new-car market grew once again last month. However, when delving deeper into the August registration figures, there are signs of a slowdown on the horizon.

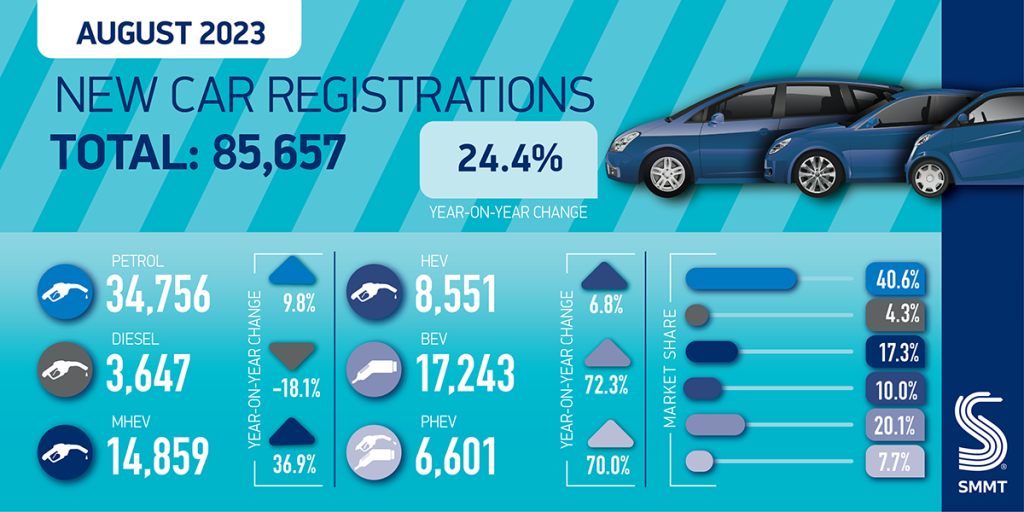

The figures, released by the Society of Motor Manufacturers and Traders (SMMT), show that in August, the market grew 24.4% with 85,657 new passenger cars registered. The month is traditionally slower, as buyers wait for the new-plate launch in September. However the August registration figures show growth of 16,799 units.

But looking at the wider market, and the reasons behind it, the August registration figures suggest that a slowdown is on the horizon. The numbers are being compared to a period last year when deliveries restarted following an extensive supply crisis. A lack of semiconductors means cars could not be built, and waiting times for customers increased. As registrations only count at the point of delivery, not the time of order, these bottlenecks and delays deeply distorted 2022 figures.

As these vehicle deliveries restarted, carmakers prioritised private consumers over fleets, as this is where their profits lay and customer service is vital. Last August was a strong month, but as comparisons are now made against a time when a flood of deliveries began, weaknesses are starting to show.

The August registration figures highlight a potential slowdown, with private registrations down by 8.1% this year. Growth last month was fuelled by the fleet sector, which saw deliveries rise 58.4% to 51,951 units, while business registrations grew by 39.4%, albeit to a smaller 1,635 units.

Therefore, as things start to balance out against even the stronger months of 2022 as recovery continued, registrations rises will likely slow, although the market will still end the year up overall, thanks to the poor start to last year, and the knock-on effect into 2023.

While the market is up year-on-year, when compared to 2019, registrations are 7.5% down in the same period, highlighting the work needed to bring the industry back up to its pre-COVID-19 level.

Is this bad for the aftermarket?

As new cars do not generally enter the independent aftermarket until the time of their first MOT, the news that fleets are driving growth is actually positive.

At this time, with an economic crisis and cost-of-living pressures, drivers are holding on to their cars for longer. Those buying a new vehicle are potentially doing so to invest. Additionally with carmakers offering longer warranties and longer finance periods, up to five years, there is no guarantee that private registrations are going to be brought into independent garages, or sold on to those who would not worry about dealer servicing, for a longer time than usual. Therefore, the decline in private deliveries in the August registration figures has been expected by market experts for a number of months.

However, the fleet market works differently. Businesses with large car numbers will generally tend to ‘defleet’ their vehicles after 36 months, rather than put them through an MOT and pay the associated repair costs. These vehicles enter the second-hand market and are bought by those who are more likely to look for the ‘cheaper’ cost of servicing provided by the independent market over the franchised dealerships.

Therefore, although new-car registrations are not going to come into the market any time soon, the increase in fleet deliveries in the August registration figures is a positive one for the independent aftermarket sector.

BEVs strong in August registration figures

Petrol again led the way in the August registration figures, with a total of 47,688 units delivered when including mild hybrids, up 18.1% over the previous year. While there seems to be no stopping the popularity of the fuel type as a push to electrification continues, the market share of petrol did drop again. In August, the technology held a 55.7% share of registrations, down by 2.4% against 2022.

Diesel continued its spiral of decline, with a total drop of 20.2% in August, and a market share taking of 6.5%, down from 10.1% in the same period last year. This is already affecting the used-car market, where supply of diesel-engine units is dwindling as buyers of new cars dry up, and those who find the technology beneficial hold onto their vehicles for longer. For the aftermarket, it means the likelihood of more diesel servicing as cars become older.

However, demand for electrified vehicles continued to grow, as evidenced in the August registration figures. Of these, battery-electric vehicles (BEVs) were the best performers, with a 72.3% increase year-on-year to secure a 20.1% market share. BEVs have constantly been the second-largest fuel type in SMMT registration figures this year, making the UK one of the leading countries in the technology. While other European markets also lead with petrol, many of the biggest count hybrid or plug-in hybrid (PHEV) models as their second largest. Outside of Scandinavia, only the Netherlands has seen such interest in BEV models.

PHEV uptake also rose significantly in the August registration figures, by 70%, to account for 7.7% of new registrations. Hybrid volumes remained relatively stable with a 6.8% increase, comprising 10% of the market.

Uncertainty looming

While registrations increase, there are big challenges ahead for the automotive industry. Firstly, there is the issue of ‘Rules of Origin’ which could mean tariffs on vehicle imports unless planned target increases for the beginning of 2024 are scrapped.

While the August registration figures show a positive movement for the BEV market, the SMMT is now concerned about the upcoming Zero Emission Vehicle (ZEV) Mandate. With four months until its proposed introduction, there has still been no sight of the rules and plans around the legislation.

This causes an issue with carmakers unknowing about what their sales targets will be, how much focus to place on ZEVs, and what they need to do pricing wise to drive the update of new battery-electric vehicles. While there are fiscal incentives for businesses to make the switch away from internal-combustion engines, there is no incentive scheme for private individuals, making BEVs an expensive purchase.

“With the automotive industry beginning a second year of growth, recovery is underway with EVs energising the market,” said SMMT chief executive Mike Hawes. “But with a new Zero Emission Vehicle Mandate due to come into force in less than 120 days, manufacturers still await the details.

“Businesses cannot plan on the basis of consultations, they need certainty. And now, more than ever, government must match action to ambition, ensuring there are the incentives and infrastructure in place to convince drivers to make the switch.”

You must be logged in to post a comment.