The UK automotive market has started 2024 with another positive month, as the fleet market again drove new-car registrations into year-on-year growth.

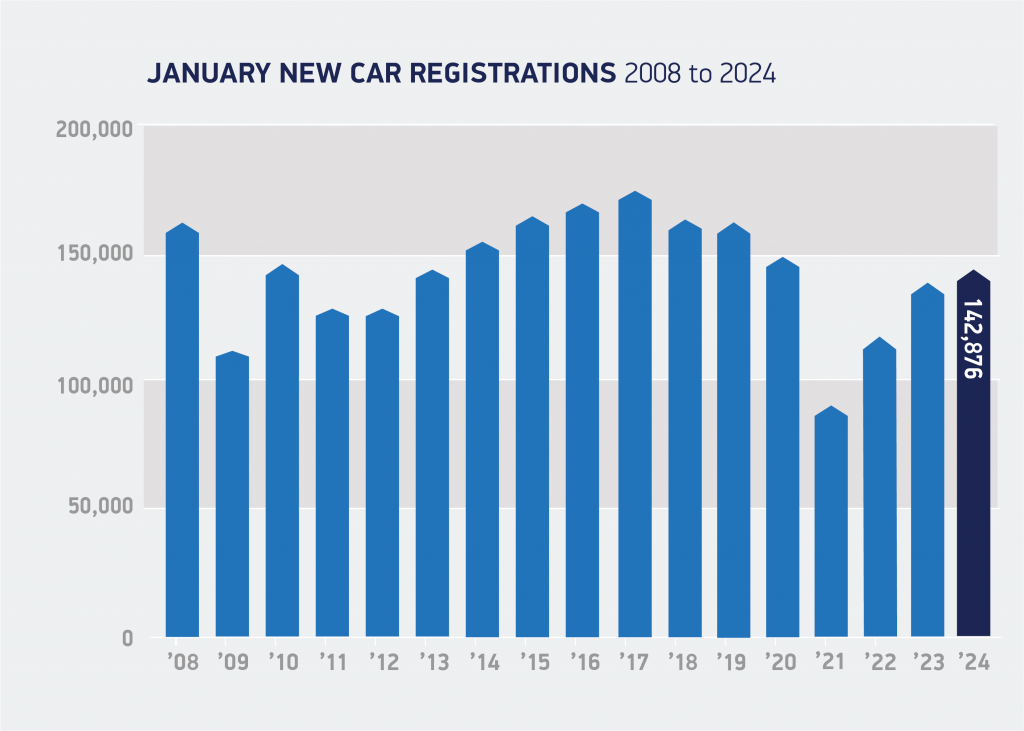

The January registration figures from the Society of Motor Manufacturers and Traders (SMMT) show that 142,876 new cars took to UK roads in January, an increase of 8.2% on the previous year. However, while the growth is positive, the figure continues a trend of slowing improvements.

January marks the third month in succession that the UK’s new-car registration figures have increased by a single-digit amount. Since the 28.3% peak rise in deliveries during July 2023, the level of improvements has fallen each month. Yet while the recovery from recent challenges may be slowing, the market has now recorded 18 consecutive months of growth.

The SMMT is forecasting that registrations will reach 1.974 million units in 2024, which would mean a year-on-year increase of 3.8%.

Fleet figures important

The January registration figures were driven by the fleet market, which improved by 29.9% in January. Private deliveries were down 15.8%, with business totals, which make up a small percentage of the market, dropping 17.7%.

Fleets and businesses again led the way in battery-electric vehicle (BEV) registrations, with a 41.7% increase in January, while private demand dropped by 25.1%. This meant that overall, BEV registrations increased by 21% in January, with 20,935 units taking to the roads.

For the independent aftermarket, the fleet total is the most important, especially when it comes to BEVs. It is from this sector that the next influx of work will come from. Fleets tend to swap their vehicles every three years, at which point they will enter the used-car market. With no ties to a franchised dealer network, buyers of these vehicles will likely look to independent garages for their servicing and repair needs.

This means that with the increase in BEV registrations amongst fleets over the last few years, and a trend that seems to continue, according to the January registration figures, an increasing number of BEVs will start to come into workshops, and those who are not trained in their specialist requirements could miss out.

Are BEVs bouncing back?

Much was made of the poor showing by BEV models in November and December, as the powertrain recorded year-on-year losses. However, the SMMT’s January registration figures reveal that carmakers were likely holding back models to deliver in the first month of the year.

January also marked the one millionth BEV registration in the country, with the overall total since the first battery powertrain delivery in 2002 now standing at 1,001,667 units.

The growth in the January registration figures can be seen as a bounce back for the technology. Whilst not a complete turnaround, the improvement suggests there was more at play than wilting demand from buyers.

The SMMT highlighted volatility in BEV supply, which is likely to continue as manufacturers adjust product allocation following the last-minute resolution over Rules of Origin (RoO), which threatened to apply tariffs to UK imports from 1 January.

This would likely have affected the January registration figures, even with their BEV growth. Manufacturers with factories in the EU would likely have looked to prioritise continental customers towards the end of 2023, as they waited on discussions over RoO to conclude. It will take these carmakers a period of time to pick up production for the UK market, which requires vehicles built to right-hand drive specifications. We can therefore expect more BEV growth than that evidenced in the January registration figures.

Carmakers are also likely to have held back BEV deliveries in December, planning to push these into the early part of 2024 to ensure these totals would count towards their ZEV mandate targets. From 1 January, carmakers need to meet specific targets for zero-emission vehicles (ZEVs) each year, with 22% of sales in 2024 needing to come from this category.

However, with disruption expected to continue in the early months of 2024, the SMMT has reduced its BEV forecast down to 21% for the year. This means 100,000 more BEVs will hit UK roads in 2024, with a total of 414,000 units expected, equating to more than one in five new cars.

‘It has taken just over 20 years to reach our million EV milestone, but with the right policies, we can double down on that success in just another two years,’ commented SMMT chief executive Mike Hawes, commenting on the January registration figures.

‘Market growth is currently dependent on businesses and fleets. The government must therefore use the upcoming Budget to support private EV buyers, temporarily halving VAT to cut carbon, drive economic growth and help everyone make the switch. Manufacturers have been asked to supply the vehicles, we now ask government to help consumers buy the vehicles on which net zero depends.’

Temporarily halving VAT on new BEV purchases would cost the UK Treasury an average of just £1,125 per car, which is less than the cost of the previous Plug-in Car Grant and, according to the SMMT, would put more than a quarter of a million electric cars on the road by the end of 2026, on top of those already expected.

Yet with other European markets amending or completely ending their incentive schemes in 2024, the UK government may wait to see the impact on these regions before deciding whether to fund potential growth in the BEV market.

Petrol dominance in January registration figures

The SMMT has changed the way it reports registration figures in 2024. Mild hybrids are no-longer separated, and are instead included within the petrol and diesel vehicle categories, dependent on their primary fuel type.

In the January registration figures, petrol-powered cars increased deliveries by 7.5%, with 81,905 units. This gave the fuel-type a 57.3% market share, a drop of just 0.4 percentage points compared to the same period in 2023.

Plug-in hybrids (PHEVs) also had a strong month, with 11,944 registrations equating to a 31.1% rise, and an 8.4% market share, up from 6.9% year on year. Together with BEVs, plug-in vehicles took a 23% share of UK registration figures in January, up from 20% a year earlier.

This growth has come at the expense of both diesel and hybrid powertrains. Diesel’s decline continued, with just 9,348 units registered in the January registration figures, a 10.1% drop leaving the fuel-type with a 6.5% market share. The decline in hybrids is the first time the market has failed to improve since August 2022. A 1.2% drop in registrations during the first month of the year left the market with a 13.4% share of January’s total, down from 14.4% at the same time in 2023.

You must be logged in to post a comment.