The September registrations data from the Society of Motor Manufacturers and Traders (SMMT) shows the market increased by 21% last month, continuing a run of monthly increases following the supply-chain crisis of 2022.

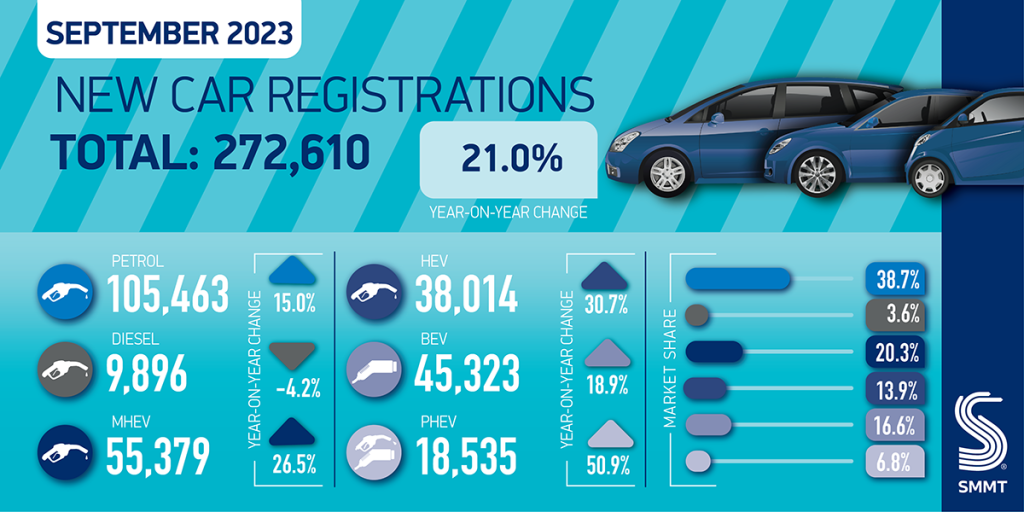

A total of 272,610 passenger cars were registered in September, making it the second busiest month for deliveries. This is due to the regular plate change, with some buyers waiting until September to have their new car registered and take advantage of the new 73-plates on offer.

Growth continued to be driven by large fleets, which rose 40.8% to 143,256 units to reach a market share of 52.5%, according to the September registrations data. This represents a market rebalancing after constrained supply in 2022 restricted deliveries to business and fleet customers. Private consumer demand, meanwhile, also grew, up 5.8% to 122,944 units. As a result, the industry enjoyed its best September since 2020, although registrations remain 20.6% below pre-pandemic levels of 2019.

ICE dominates September registrations

Petrol continued to dominate the UK automotive market in the September registrations data. When including mild hybrids, the fuel type saw registrations increase by 19.7% compared to the same month in 2022. In total, 151,846 new units took to the roads, representing a 55.7% market share. This is down by 0.6% on 2022.

Diesel registrations, including mild hybrids, remained stable, dropping just 0.1% in September to record a market share of 6.9%, down 1.5% on last year. The fuel-type, which once dominated the market on its own, is now in danger of being the lowest-performing technology in the figures, ending the month just 0.1% ahead of plug-in hybrids (PHEVs), which recorded a 6.8% share of the market, thanks to a 50.9% increase in September registrations.

Hybrids saw 38,014 registrations, meaning they ended the month 30.7% up on last year, with a 13.9% market share.

Private BEV sales drop, what is the cause?

Although the UK’s automotive recovery continued into a 14th month, there are concerns in the industry over the second decline in private BEV registrations in the space of two months, shown in the September registrations data.

However, this may be due to the ending of the plug-in car grant (PiCG) in July 2022. The supply-chain crisis, which affected vehicle production levels in 2021 and the first half of last year, led to a backlog of deliveries, with many buyers waiting between 12 and 18 months for their new vehicle.

Registration data records the point at which a vehicle is delivered to a customer, not the date of which it is sold. Therefore, the 14.3% drop in private BEV registrations may be due to a slowdown in orders after the PiCG was axed. This would likely have led to a reduced demand for BEVs, which would have become more expensive to buy. This drop may only now be showing in the September registrations figures, as cars ordered in August 2022 and onwards, without the finding from the PiCG, are being delivered.

The dip in the September registrations figures will not have come from a lack in confidence of electric vehicles following the announcement of the delay in the banning of new petrol and diesel sales. As this was made two weeks ago, there is no possibility it could have affected deliveries, as the lead time between ordering and delivery is longer than this period.

However, the drop could not come at a worse time for the automotive market, which saw the publication of the new Zero Emission Vehicle (ZEV) Mandate which brings with it strict targets for sales of ZEVs up to and including 2035. Despite the change in policy, the ZEV Mandate has not been adapted, meaning that while carmakers can still sell new petrol and diesel models until 2035, they will need to push BEV technology by the end of the decade.

The mandate states that sales, rather than registrations, of new vehicles for each carmaker must include 22% ZEVs in their fleets in 2024, rising each year, reaching 52% in 2028, 80% of fleets by 2030, and 100% by 2035. Yet with the charging infrastructure in the UK growing slower than demand requires, and the introduction of vehicle excise duty on new BEVs from 2025, it is becoming harder to justify the already expensive purchase of a BEV over an internal-combustion engine counterpart.

Despite the UK now having the toughest zero-emission transition timeline in Europe, with an end date aligned to the European Union, the country does not have any incentive scheme in place to entice private buyers, unlike other major European markets. The September registrations data shows that incentives for purchasing BEVs has worked in the past, and if the drop-off is due to the PiCG axe, then an alternative may be needed to entice private buyers back to the market.

‘With tougher EV targets for manufacturers coming into force next year, we need to accelerate the transition, encouraging all motorists to make the switch,’ commented SMMT chief executive Mike Hawes. ‘This means adding carrots to the stick, such as creating private purchase incentives aligned with business benefits, equalising on-street charging VAT with off-street domestic rates and mandating charge point rollout in line with how electric vehicle sales are now to be dictated.’

You must be logged in to post a comment.