New-car registrations are continuing their upward trend with a seventh month of growth in a row.

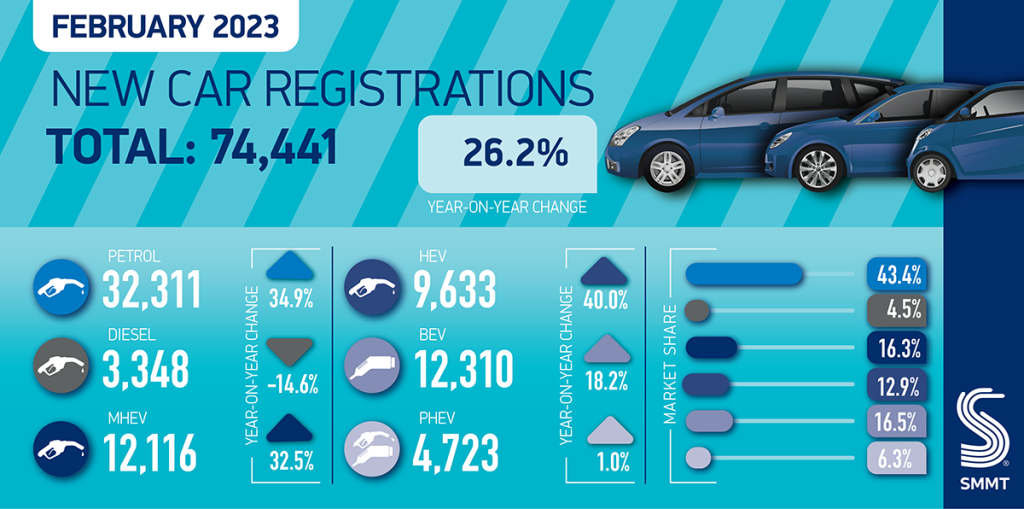

The February new-car registrations data released by the Society of Motor Manufacturers and Traders (SMMT) shows that 74,441 vehicles joined the UK roads last month, a 26.2% rise over the second month of last year.

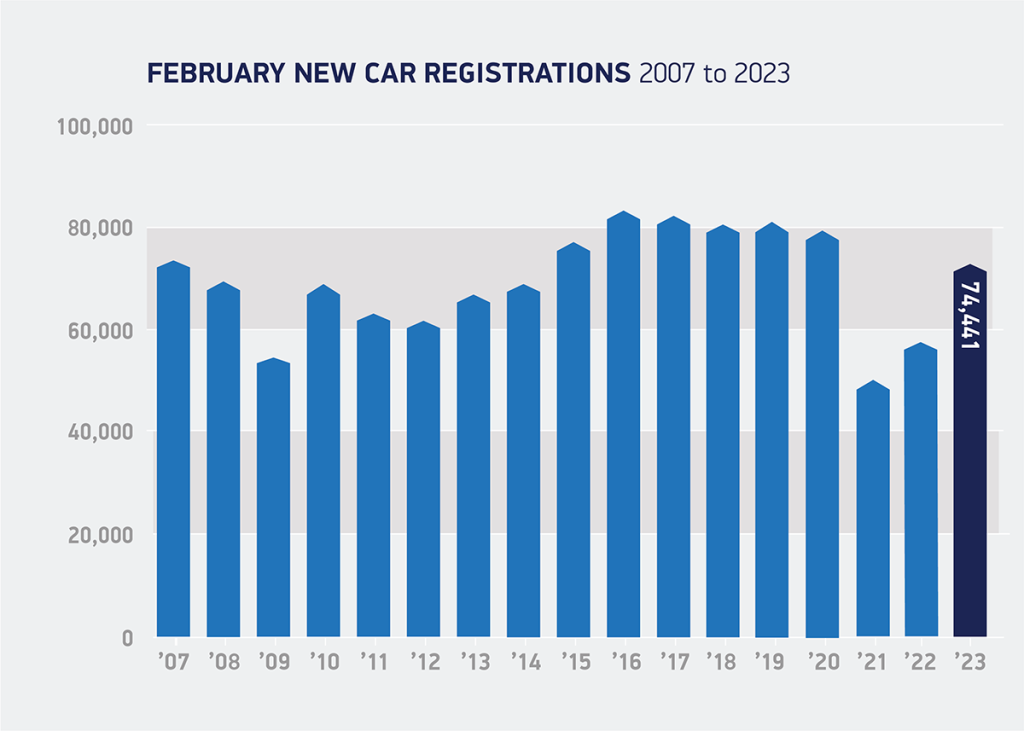

February is often seen as a ‘low-volume’ month with buyers gearing up for the traditional plate change in March. However, with delays around new-car deliveries having impacted registrations for the last two years, and the fact that registration data counts from point of delivery, not date of sale, it is clear the industry is still catching up with demand.

Yet February new-car registrations in 2023 are still down on pre-pandemic levels. Last month was down 6.5% on 2020 numbers – the last month before disruption hit the automotive industry.

Petrol stars in February new-car registrations figures

While there is much buzz around electric vehicles (EVs), it was the petrol market that starred in the February new-car registrations. In total, 42,378 vehicles leaving showrooms were petrol powered, an increase of 26.3% or 11,165 units year-on-year and a 56% market share.

Battery-electric vehicles (BEVs) also recorded growth, but the 18.2% change represented an increase in registrations of just 1,893 units. Plug-in hybrid registrations grew 1%, giving zero-emission capable vehicles a market share of 22.8%, less than a quarter of the market according to February new-car registrations data.

While there have been a number of stories around drivers abandoning EVs and moving back to petrol models, mainly due to increased costs and lack of infrastructure, it is unlikely that these figures are reflected in the February new-car registrations. With supply issues still meaning a longer waiting time for vehicles, especially BEVs, we will not know the true impact, if any, on these decisions and reports until later this year.

The SMMT believes that around 488,000 PHEVs and BEVs will join UK roads in 2023, due in part to manufacturers brining more than 40 new plug-in variants to the market. This will only increase the pressure on the country’s charging infrastructure. The government has pledged £56 million for local infrastructure funding, yet while this is welcome, it may not be enough and binding targets for charging rollout are needed.

“Although February new-car registrations need to be taken with a grain of salt with March being far more important, these results are troubling for electric car adoption and follow similar results in January,” commented Stuart Masson, Editorial Director at The Car Expert.

“The data shows that overall new registrations were up by 15,000 units in February, but 11,000 of these increased sales were petrol-powered cars. EVs improved by less than 2,000 sales, so we’re seeing petrol cars increasing in market share while EVs have gone down. This is going the wrong way.

“Looking ahead to March, we expect to see Tesla shifting a lot of EVs, which should ‘balance the books’ to a certain degree. But other brands will need to start growing their EV sales to make the necessary inroads on fossil-fuelled vehicles. There are always high expectations in March from across the industry, a lot will be riding on next month’s results and it will be interesting to see how flexible brands become with offers, and whether EV sales increase more rapidly.”

The decline of diesel also continued in February, with just 5,397 cars registered. The modest drop of 7% masks the dramatic downturn in recent years, with the fuel-type once leading the way and commanding almost half of the UK market. Today, the share is just 7.3%. However, garages should not read too much into the poor diesel performance in the February new-car registrations figures, with millions of older models still on the roads, and many being kept for longer by those unwilling to give up their cars.

Good times for the automotive industry

The month saw almost universal growth across the market, with deliveries to private buyers up 5.8% and those to large fleets up 46.2%. Business registrations, which account for a fraction of the market, increased by 0.7%, equivalent to just nine units.

There was also growth in all but two segments, with only registrations of executive and luxury saloon cars falling, by 15.4% and 6.3% respectively. Minis (up 66.1%), multipurpose vehicles (41.9%) and superminis (37.7%) posted the largest percentage uplifts, with superminis remaining the most popular, accounting for a third (33.1%) of all deliveries.

February new-car registrations show that the automotive industry is on track, with the SMMT forecasting a year of double-digit growth. This will also help the aftermarket, as cars traded in will likely enter the sector with owners not concerned over having them serviced at dealerships. So the news that registrations continue to improve are good all round.

With this in mind, the SMMT believes that the Spring Budget is an important opportunity to shape Britain’s net-zero progress and deliver ‘an equitable transition for all’. This should include a long-term plan for charge point investment, aligning VAT on public charging with domestic energy use, and reviewing the Vehicle Excise Duty premium that the lobbying body says will unfairly penalise EV buyers switching to this inevitably more expensive technology in the future. With the slow uptake of BEVs shown in the February new-car registration figures, these measures would help drivers considering switching to a zero-emission vehicle.

“After seven months of growth, it is no surprise that the UK automotive sector is facing the future with growing confidence,” said Mike Hawes, SMMT Chief Executive. “It is vital, however, that government takes every opportunity to back the market, which plays a significant role in Britain’s economy and net zero ambition. As we move into ‘new plate month’ in March, with more of the latest high-tech cars available, the upcoming Budget must deliver measures that drive this transition, increasing affordability and ease of charging for all.”

You must be logged in to post a comment.