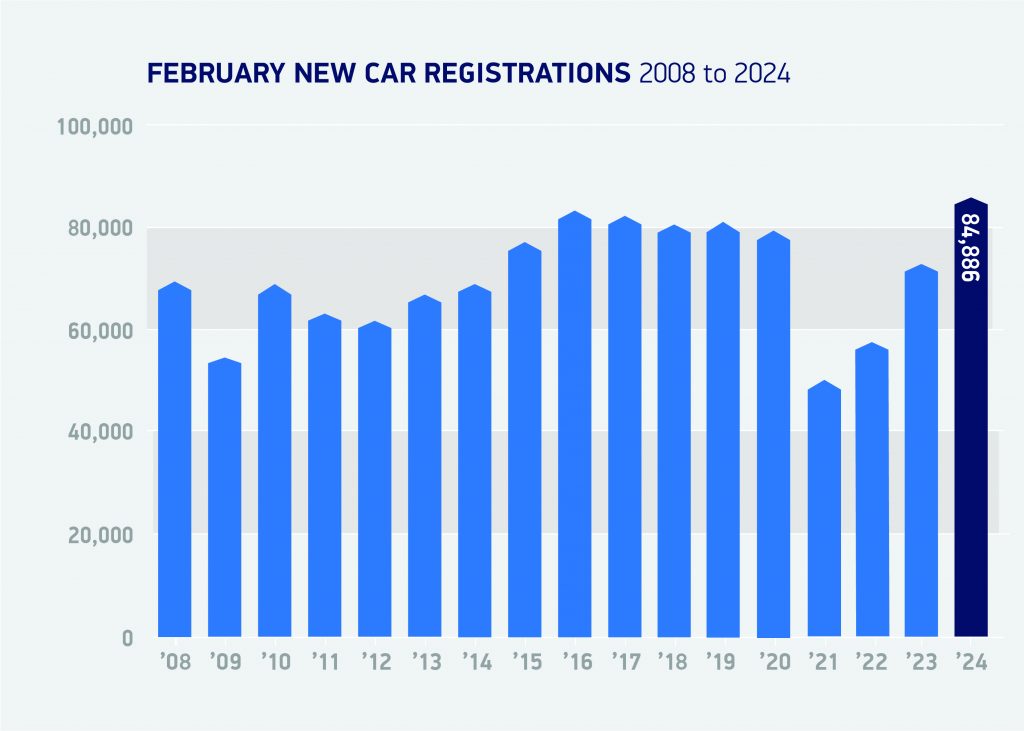

The UK new-car market produced a surprise in February, with the best result in the month for two decades, as the recovery slowdown saw a bounce.

February new-car registrations were up by 14%, with 84,886 units delivered to customers, according to the data released by the SMMT. This marked the 19th consecutive month of growth, and was the first double-digit rise in four months, suggesting 2024 could be a good year for overall growth.

However, it was once again the fleet market that drove numbers up. The February new-car registrations data shows that investment from large fleets and smaller businesses were entirely responsible for the good figures, with deliveries up 25.2 and 15.5% respectively. Private uptake continued to struggle, with registrations down 2.6%.

It therefore seems that consumers are unwilling to invest in new cars at present. This should prove to be a bonus for the independent aftermarket, as drivers are either keeping hold of their cars for longer, or turning to the used-car market for a cheaper newer model than their current vehicles.

The increase in fleet registrations in the February new-car registrations figures is also a positive for the independent sector, although not one that will be seen straight away. These vehicles are more likely to move into the second-hand market after three years, and are less likely to be sold via franchised dealer channels, meaning it will be probable they end up in smaller workshops for their servicing needs.

February new-car registrations are traditionally slower, returning lower volumes as buyers wait for the plate change in March. Therefore, the impressive performance last month is cause for optimism in the months ahead.

Electric surges in February new-car registrations

Hybrids saw a 12.1% rise in February, with 10,801 units delivered to buyers in the month. However, their market share dropped slightly to 12.7% of the total. Plug-in hybrids (PHEVs) recorded the largest growth amongst powertrain types, with numbers up 29.1%. Yet this was only on smaller totals, with 6,098 deliveries last month.

Of models with electrified powertrains, it was once again the battery-electric vehicle (BEV) market that led the way. A total of 14,991 units were delivered to buyers in the month, 21.8% up year on year and a 17.7% market share, up from 16.5% in February 2023.

However, while BEV market share and volumes continue to grow during the first year of mandated targets for manufacturers, the increase in uptake is entirely sustained by fleets, thanks to compelling fiscal incentives. Private buyers account for fewer than one in five (18.2%) new BEVs registered in 2024 so far, according to the SMMT in its February new-car registrations release.

Again, for the independent aftermarket, this is more optimistic than it sounds, due to the increase in fleet buyers, and the near certainty that these models will enter workshops in the next three years. It is therefore crucial for garage owners to take note of the fleet market in the coming months. While the February new-car registrations figures cause concern over private uptake, for the aftermarket, the fleet figure is the one to track.

It is likely that carmakers are prioritising fleets over private buyers for deliveries. Registrations count at the point the vehicle takes to the road, not when it is ordered. With the ZEV mandate stating that carmakers must reach a target of 22% of registrations as zero-emission models, sending cars to cover larger orders is more likely to bring results.

Petrol leads, diesel down

Once again, it was the petrol powertrain that led the way, dominating the February new-car registrations figures as 48,001 models were delivered, up 13.3% over last year. The fuel-type held 56.5% of the market, with mild hybrids included in those results.

Diesel, however, hit a new low. Including mild hybrids, just 4,995 units were registered last month, a drop of 7.4%. This means diesel has started the year extremely poorly and saw its monthly market share drop from 7.3% in February 2023, to just 5.9%.

Internal-combustion engines are still leading the way when it comes to powertrains, evidenced in the February new-car registrations. Yet the market is being pushed towards electrification, and most new models launched by carmakers feature some form of electric propulsion.

The recent Geneva International Motor Show saw every mainstream model launched with electric drive. The new Renault 5 will be supplied as a BEV, while the MG3 has been given a facelift, and will be ditching its 1.5-litre petrol engine for a hybrid powertrain. The carmaker also introduced its luxury brand, IM, with its L6 model destined for the UK BEV market.

Chinese brand BYD was also in attendance, with several models, all coming to the UK in the months ahead. Most prominent was the European launch of the Seal DM-I plug-in hybrid SUV, while models from its sub-brands Yangwang and Denza are also going to reach these shores in the months ahead.

Therefore, while petrol proves popular, it is only a matter of time until all carmakers phase the technology out, in favour of cleaner electrified drives, whether they are hybrid or pure electric.

You must be logged in to post a comment.