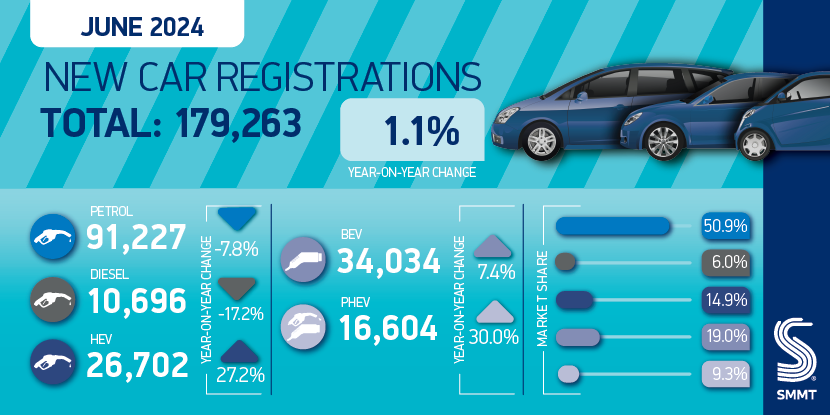

The UK’s new-car market has recorded another month of growth, with the latest registration figures from June showing a modest 1.1% improvement.

The data from the SMMT also confirmed that at the halfway point of the year, over one million new vehicles had hit the roads, the first time the market has reached this point since 2019. However, this growth has been driven by fleets once again.

There has also been a slowdown in the uptake of battery-electric vehicles (BEVs), which grew, but were outpaced by improvements amongst other electrified technologies. However, petrol remained the dominant powertrain type, despite a decline in the month, according to the registration figures.

With an election in full swing, there was an expectation that the registration figures would show a decline in June, as buyers waited to see what a new government would bring to the automotive industry. However, the continued trickle of deliveries has continued.

“The year’s midpoint sees the new car market in its best state since 202, but this belies the bigger challenge ahead,” commented Mike Hawes, SMMT Chief Executive. “The private consumer market continues to shrink against a difficult economic backdrop, but with the right policies in place, the next government can re-energise the market and deliver a faster, fairer zero emission transition.

“All parties are agreed on the need to cut carbon and replacing older fossil fuel based technologies with new electrified powertrains is the essential step to achieving that goal.”

Fleet success in registration figures

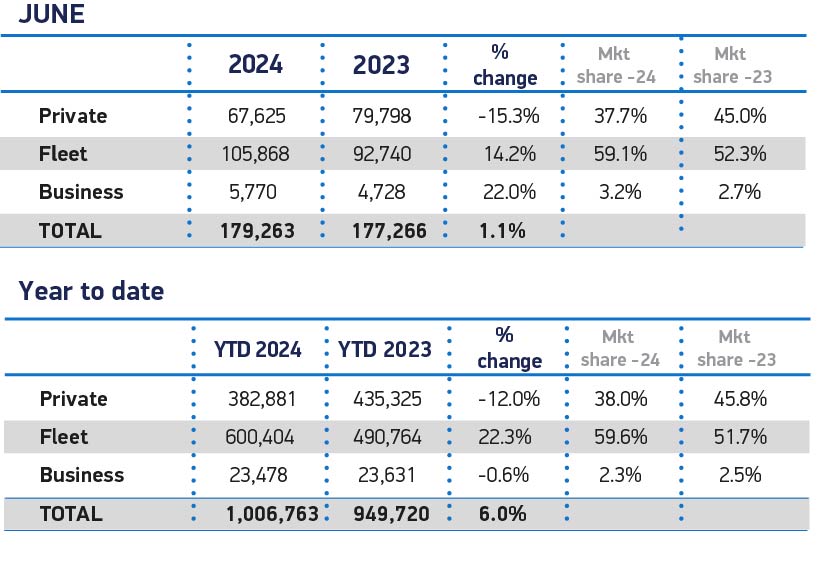

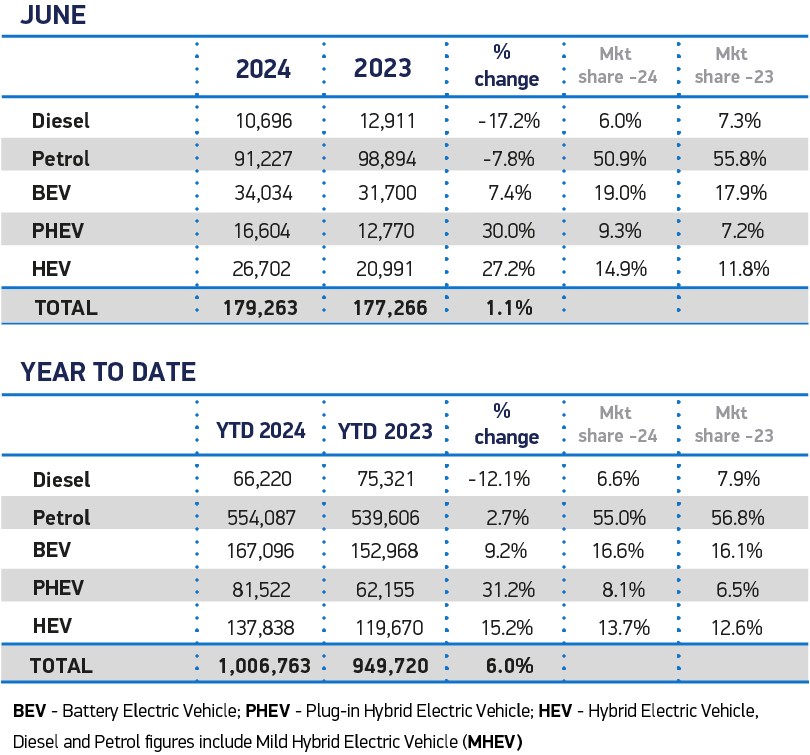

Fleets have driven the registration figures for the last nine months, with the new-car market now reliant on large companies restocking their vehicle parcs.

This is good news for the aftermarket. It shows that private buyers are holding onto their cars for longer, while in three-years’ time, the higher number of fleet cars will come into the used-car market, which is a feeder channel to the independent garage network.

In June, the registration figures show a 14.2% increase in registrations by fleets. This equated to 105,868 new vehicles in the month, and gave the sector a 59.1% market share.

The private sector, however, declined by 15.3%, with 67,625 registrations and a 37.7% market share. This is the ninth decline in a row, which is shown in the year-to-date figures, as the market is down 12%, compared to the fleet sector’s 22.3% growth over the first half of 2024.

Electrified growth

Electrified vehicle uptake continued to grow robustly in the latest registration figures, with plug-in hybrid (PHEV) volumes up 30% to reach a 9.3% market share, while hybrid electric vehicles (HEV) rose 27.2% to achieve 14.9% of the market.

Both powertrains outpaced BEV growth, which rose 7.4% but took its highest monthly share this year, accounting for 19% of all new vehicle registrations. The BEV market is now entering a difficult phase, with early adopters having already purchased their all-electric models, and growth required against record numbers in 2023.

The UK’s zero emission transition – and the ability of manufacturers to meet the requirements of the Vehicle Emissions Trading Scheme – currently relies on the fleet sector as private consumer uptake continues to soften. Private BEV uptake has fallen by 10.8% year to date, with fewer than one in five new BEVs going to private buyers according to the registration figures.

Overall, BEVs now comprise 16.6% of the new car market so far this year, slightly above the 16.1% achieved in the same period last year, with uptake behind the levels mandated by government.

However, there may be an opportunity for growth in the coming months. With the implementation of tariffs on BEVs imported from China into the EU, Chinese manufacturers may focus their efforts on the UK market, bringing new models into the country, all of which will be more cost-effective against their European rivals.

The SMMT also has its views on how to build growth, especially with the zero-emission vehicle (ZEV) mandate in action. It believes that there is a need to re-instate incentives for the private consumer by way of a halving of VAT on BEVs for three years. This would help ensure that in 2035, half of all cars in use would be zero emission, cutting road transport CO2 emissions by 175 million tonnes between now and then.

Petrol demand drops

The UK is still driven by petrol powertrains, with 91,227 units delivered in June, according to the latest registration figures. However, this was a drop of 7.8% year on year, with the 50.9% market share falling from the 55.8% held in the same month of 2023.

Diesel continued its struggle, with a 17.2% fall in deliveries as 12,696 units took to the UK’s roads. The technology only commands 6% of the overall market, as buyers shun the technology, looking instead at the used-car sector for purchasing these models.

You must be logged in to post a comment.