Independent garage labour rates are rising quickly, according to new data from Garage Industry Trends, an open real-time data platform developed by Garage Hive.

The average labour rate of garages that are opted in to Garage Industry Trends have risen from £66.30 per hour on average to £67.60. The data-gathering site went live on 17 September and has been monitoring trends for seven weeks.

During this time, prices rose on six out of these seven weeks, and the rise of £1.30 in this time would equate to an increase of £9.70 or 14.6% by next September, if sustained.

The growing number of opted-in Garage Hive customers generating the figures is now around 100 independent garages.

“Garage labour rates jump out as they are showing a consistent trend upwards,” said Alex Lindley, Director of Garage Hive.

“We have got to be careful in how we interpret this data and the conclusions we draw,” he added. “The garage sample group changes as more garages opt in, but at the moment the increase in garage labour rates is clear and not unexpected.”

The four KPI measures provided at www.garageindustrytrends.com are averages for invoice value, Net Promoter Score (NPS), future bookings and labour rate.

Garage labour rates hit by cost-of-living issues

Rising costs of living are not helping garage labour rates, which are driven by factors including a shortage of skilled technicians, hikes on the costs of parts and consumables, increasing energy prices, alongside escalating rents or mortgages, and fuel bills.

“It is a turbulent time for many UK businesses,” said Lindley. “So being able to quickly check your experience against an industry average is of more use right now than ever before.”

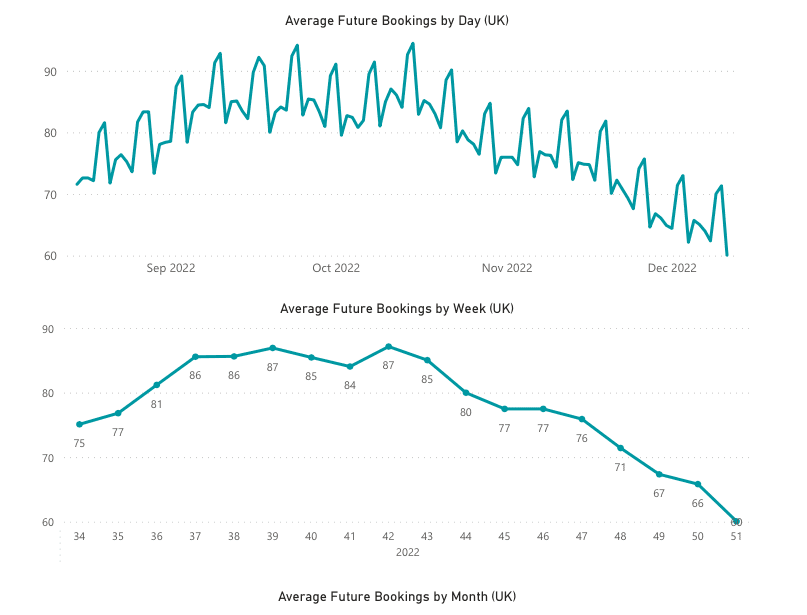

Over the same seven-week period the number of future bookings for garages has shown a sharp fall – dropping from a peak average of 87 bookings on average to just 71 future bookings for week commencing 28th November.

However, it seems unlikely rising garage labour rates are simply driving customers away.

“Motorists are feeling pressure on household budgets so there may be an element of delaying work,” Lindleycontinued. “However, we think the primary causes of this drop are first, the end of the year is traditionally slightly quieter and secondly, bookings still vary to the pattern embedded by the six-month MOT extension.”

This ‘COVID-effect’ from March 2020 is reducing over time, but Garage Industry Trends shows a clear pattern; a rise in future bookings was seen ahead of a plateau from 12 September to 30 October, which has since been reducing.

Those wishing to look at the trends or analyse the data are welcomed to draw their own conclusions by visiting www.garageindustrytrends.com.

You must be logged in to post a comment.