After five consecutive months of decline, the UK’s new-car market bounced back in March. With the country’s ‘new-plate’ month often producing larger registration volumes, this year saw electrified vehicles benefit. The improvement comes as the government makes changes to certain ZEV mandate targets, to help the automotive industry.

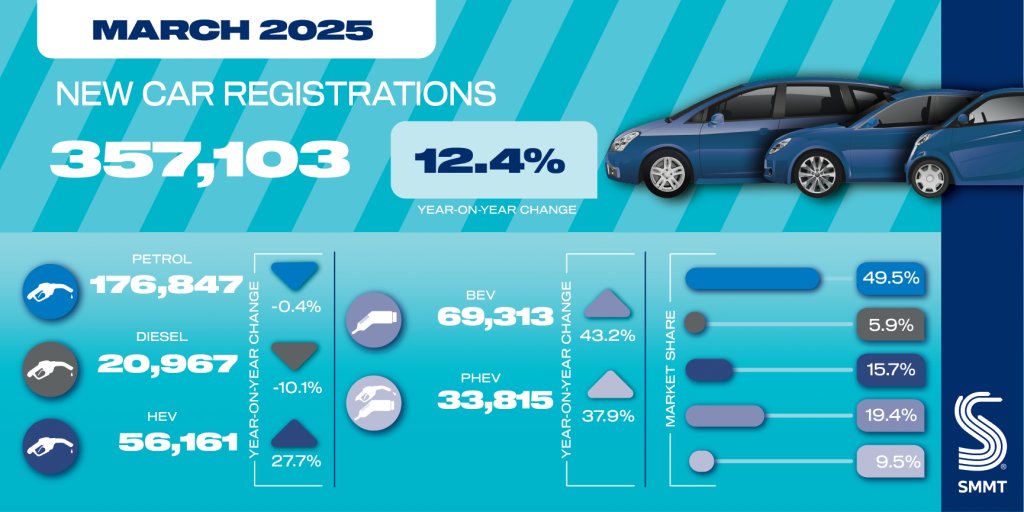

The latest data from the SMMT reveals that registrations in the UK grew 12.4% in March. A total of 357,103 units were delivered to customers, up by 39,317 models year on year. This is the best March total since 2019, and brings an end to a run of declines stretching back to October 2024.

The performance saw a turnaround in the market’s year-to-date fortunes. Figures over the first three months returned to growth, with registrations up 6.4%. A total of 580,502 new cars were delivered over the first quarter, up by 34,954 units year on year.

However, the market is far from stable at present, and the rise in the ZEV mandate target for this year has caused concern in the industry. Together with the upcoming 2030 petrol and diesel new-car ban, pressure on the market has increased in recent months. Yet new announcements by the UK Government are aimed to alleviate these concerns.

The path to 2030

In the wake of global political and financial turmoil, the UK government has announced measure to boost the new-car market. Alongside a relaxation in the rules around the 2030 petrol and diesel new-car ban, it is also revising the ZEV mandate. Targets remain, but the opportunities to avoid financial penalties are increased.

Pure internal-combustion engine (ICE) models will be banned from new car sales in 2030. However, both full hybrid (HEV) and plug-in hybrid (PHEV) models will continue to be sold until 2035. Carmakers will need to ensure that overall CO2 emissions from these models is 10% lower than their baseline 2021 figures.

Meanwhile, in the van market, petrol, diesel, HEV and PHEV sales will continue until 2035. Manufacturers must ensure that CO2 emissions between 2030 and 2035 do not grow above levels from 2021.

Small-volume manufacturers with registrations between 1,000 and 2,499 units, and micro-volume manufacturers with registrations under 1,000 units, will be exempt from the 2030 to 2035 hybrid requirements. These businesses will need to meet a nominal CO2 reduction across their fleets during this period, which will be agreed individually.

ZEV mandate amendments

To reduce the pressure on carmakers in the UK when it comes to ZEV mandate targets, the government has reduced the fine-per-unit over the required target. Manufacturers will now pay £12,000 per car over the zero-emission model threshold, a drop of £3,000.

However, flexibilities to transfer credits between car and van markets, and from less-polluting models, have been improved within the ZEV mandate wording.

In the new ZEV mandate plans, one car credit can be exchanged for 0.4 van credits, while one van credit can be exchanged for two car credits. This is derived from relative mileage and CO2 emissions. This flexibility would be uncapped and available from this year onwards.

Currently, carmakers can create credits by cleaning up their non-ZEV fleet compared to their 2021 CO2 baseline. This ability was set to expire next year, but will now be extended to 2029. Therefore, manufacturers now have flexibility to reward any CO2 savings from their hybrid fleets towards their ZEV mandate targets.

However, this flexibility will be capped each year, ensuring the ZEV mandate continues its goal of driving zero-emission sales.

In 2025, the original emissions flexibility was capped at 45% of the total ZEV mandate requirement. This has now doubled to 90%. Therefore, 25.2% of a carmaker’s fleet target can be made up of non-ZEV cars based on emissions trading credits.

The cap drops by 10 percentage points each year until 2029, when it reaches 50%. The existing ZEV mandate targets remain, yet the push for more HEV and PHEV options in carmaker line-ups should allow for enough emissions trading to reduce the likelihood of penalties.

The ZEV mandate period where credit borrowing from other manufacturers is also extended to 2029, with the borrowing threshold dropping each year. From a 50% maximum in 2025, the cap falls to 25% in 2026, and then by 5pp until it reaches 10% in 2029.

The industry reacts

“The government has rightly listened to industry, responded quickly to global dynamics and recognised the intense pressure manufacturers are under. Industry remains committed to decarbonising road transport but the ZEV mandate targets are incredibly challenging, especially with a paucity of consumer demand and geopolitical upheaval,” commented SMMT chief executive Mike Hawes.

“Growing EV demand to the levels needed still requires equally bold fiscal incentives, however, to give motorists full confidence to switch.”

Kevan Wooden, CEO of LKQ UK and Ireland, added: “It is encouraging to see the government reacting quickly to help shore-up confidence in the automotive sector, which faces fresh uncertainty from US tariff reform. And while this week’s intervention is understandably made in the interests of vehicle manufacturers, there are welcome outcomes for the aftermarket too.

“Further clarity over the 2030 ICE vehicle ban gives the independent aftermarket the confidence to invest in the skills and equipment needed to service and repair electric vehicles. Meanwhile, applying the 2035 deadline to all hybrid vehicles and for vans gives certainty to the aftermarket that revenue opportunities relating to ICE aspects of hybrid servicing will remain for longer.

“A stable and predictable policy environment is central to the wider automotive industry’s success. The government rightly brought forward these plans to support vehicle manufacturers at a time of uncertainty. But there remains an opportunity for the government to provide greater clarity on EV policy for the aftermarket too: a crucial part to support the future success of the UK’s zero emission car parc.

“Policy that grows EV servicing skills, and that prevents vehicle manufacturers from blocking repair opportunities for the independent sector, will be key to providing greater stability and predictability.”

No incentives

While outlining amendments to the ZEV mandate and 2030 new-ICE ban, the government has stopped short of announcing incentives for the purchase or ownership of an electric vehicle. At the recent SMMT Electrified conference, calls were made for a reduction in VAT on public charging, to benefit those without access to off-street parking.

There were also calls for the Expensive Car Supplement (ECS), applicable to vehicles registered from 1 April, to be raised by £20,000 to £60,000, to avoid it impacting the ZEV market.

The ECS will see £425 added to the standard VED rate in years two to six of registration, with the technology having been previously exempt.

Whether the ZEV mandate amends may help reduce fines, the lack of incentives could continue to hamper sales. Therefore, there needs to be more clarity, to ensure the market knows what the future of powertrain technology will look like.

Best month for BEVs

Battery-electric vehicles (BEVs) led the market in terms of registrations increase in March. The 69,313-unit total was 43.2% higher than the same month in 2024. This equated to a rise of 20,925 units year on year. This was the largest ever monthly volume for the powertrain.

However, the SMMT reports that manufacturers offered significant discounting, as they sought to deliver more ZEVs to drivers during the new ’25 plate’ month. As March usually accounts for around 16% of annual registrations, it was important to have as many deliveries as possible, to count towards their ZEV mandate targets.

The introduction of VED from 1 April, which will see a £10 tax during the first year of registration, rising to £195 annually therefore, could impact the market. Additionally, new BEVs registered on, or after, 1 April, will be eligible for the ECS if they cost more than £40,000. This may explain the higher March figures, with drivers aiming to avoid that charge.

The increase means that the all-electric technology’s market share jumped by 4.2pp, to 19.4%. It was the second-best powertrain in the month, ahead of HEVs but some way behind petrol. Yet this share, while significantly improved, is 8.6pp behind the 29% ZEV mandate target for this year. With the VED and ECS changes, figures may struggle to reach the required 28%.

In the first quarter, BEV registrations have increased by 42.6%, thanks to the push, and discounting, by manufacturers. A total of 120,191 units have taken to UK roads, with a 20.7% share of the year-to-date total. Again, this is below the ZEV mandate target for 2025.

Hybrid growth continues

Unlike other European markets, the SMMT mixes mild-hybrid registrations with their equivalent petrol and diesel counterparts, this means figures for the hybrid market are based on HEVs and PHEVs.

HEVs achieved a rise of 27.7% in March, with 56,161 registrations. This led to a 15.7% market share in the month, up by 1.9pp. In the first quarter, the powertrain was up 18.7%, with 86,005 units delivered. This was a 14.8% hold of the total across the first three months of 2025, up by 1.5pp.

Meanwhile, PHEVs saw growth of 37.9% year on year, albeit on smaller volumes. Their improvement in March of 37.9% meant 33,815 models took to the road. This gave the powertrain a 9.5% share of the market, up from 7.7% recorded a year previously. Between January and March, PHEV registrations rose 26.1%, with 53,86 registrations, a 9.2% market share. This was up 1.4pp year on year.

Petrol proves popular

Petrol, including mild-hybrids, continued to lead the market in March. However, the 176,847-unit total was down 0.4% year on year, a difference of just 738 units.

The performance was the best of the year for the powertrain, following double-digit losses in January and February. It meant that petrol accounted for 49.5% of the market, although this was a drop of 6.5pp compared to March 2024.

In the first quarter, petrol registrations fell by 7.1%. The performance in March helped to reduce this loss, which stood at 16.1% over the first two months of the year. A total of 286,787 units were delivered, taking 49.4% of the total. This is a drop from the 56.6% share recorded in the first three months of 2024.

Diesel was both the least popular and worst-performing powertrain in March. The 20,967-unit total was 10.1% down year on year, while its 5.9% market share was 1.4pp off the hold in March 2024.

Over the first three months of the year, diesel deliveries have declined 10.2%, with 33,833 units. The powertrain’s market share of 5.8% is down from the 6.9% held at the same point last year.

Combined, ICE registrations in March fell just 1.5%, or 3,083 units. The group made up 55.4% of the market, a drop of 8.1pp. In the first quarter, ICE deliveries fell 7.4%, with the 55.2% hold down from the 63.5% recorded during the same period of 2024.

You must be logged in to post a comment.