The UK’s new-car market recorded a 22nd consecutive month of growth in the May registrations figures, but once again, it was the fleet sector that drove deliveries.

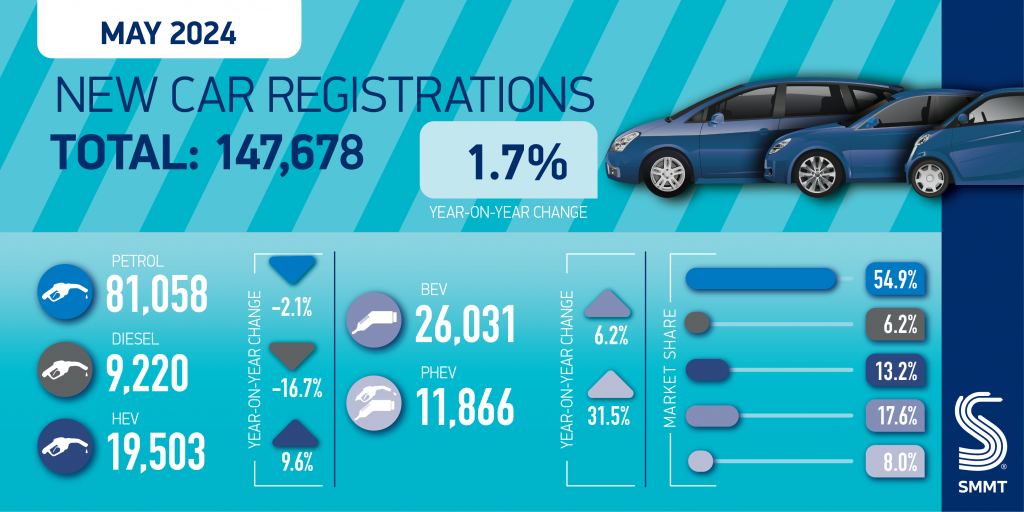

The latest data from the SMMT shows a 1.7% increase compared to May 2023. This highlights that the market, while improving, has continued to slow, following the 1% improvement in April.

With figures now being compared to a period of strong growth following the end of the supply-chain crisis, the UK’s new-car sector is likely to show lower improvements from now on. The May registrations follows a 1% improvement in April.

The growth in May owed everything to electric vehicles (EVs), with battery-electric vehicles (BEVs) in particular helping towards the slight market growth, as internal-combustion engine deliveries faltered.

Fleets lead May registrations

The UK’s deliveries growth in May registrations owes everything to the fleet and, to a smaller extent, business sectors. The UK has become heavily reliant on the larger fleet sector to keep numbers up. Fleets have led registrations figures since October 2022. Before then, the private sector was the leading market, for a run beginning in August 2021.

Last month, new-car deliveries to fleets increased by 14%, continuing its trend of leading the growth in the market. Of all registrations in the UK, those going to fleets accounted for 58.8%. This figure has grown from the 52.5% seen in May last year, while other market shares have declined.

While the overall market will continue to worry about the issues within the private sector, for the aftermarket, the growth in fleets is good news. Increased numbers not only mean increased defleeting taking place now, but in three-years time, these new models will also enter the used-car market, and are therefore likely to come into the independent garage sector.

The last time fleets were outperformed was in January 2023, when business registrations experienced a greater increase, albeit on much lower volumes.

Private registrations declined again, according to the May registrations data, with deliveries dropping 12.9% in May. This continued a run of losses stretching back to November 2023. The last improvement in the private sector was a 0.3% rise in October of that year. Last month, the share of the overall market held by private deliveries was 38.9%, down from 45.4% in May 2023, a considerable drop.

In the year to date, while fleet registrations are up by 24.2%, private deliveries are down 11.3%.

EVs lead the way

BEVs continued to be the UK’s second-best powertrain technology in May. The all-electric sector saw growth of 6.2% in the month, outperforming the overall market.

While there have been concerns around a slowdown in the UK’s BEV market in recent months, May registrations numbers saw the technology’s market share jump by 1pp, to sit at 17.6% of all registrations.

In the year so far, BEVs hold a 16.1% market share, close to the 16.5% it achieved across the whole of 2023, and up from the 15.7% recorded in May of last year. While the market has slowed from the regular double-digit registration increases seen in 2023, the 9.7% year-to-date figure represents 133,062 units, ahead of both HEV and PHEV powertrains.

However, this market share is some way below the 22% target set out for manufacturers in the ZEV mandate. While each manufacturer will have a different unit target to reach the threshold, the overall market performance suggests that some will have a way to go in order to make the cut.

Full hybrids recorded 19,503 registrations in the May registrations data, up by 9.6% year on year. PHEVs performed even better, with growth of 31.5%, although this was based on a lower volume total of 11,866 in May.

For PHEVs, this meant a market share of 8%, helping its year-to-date figure to climb to 7.8%, from a 6.4% share a year earlier. May’s performance helped, therefore, to increase the gap between the powertrain technology and diesel. While the plug-in technology finished as the least-popular drive option in 2023, it now seems set to avoid this fate, with its ascendancy matched by the declines of diesel.

ICE stalls

A sign of weakness in the UK market, highlighted by the May registrations data, was the performance of the internal-combustion engine (ICE) market. Both petrol and diesel suffered declines in the month.

Petrol suffered a 2.1% decline, making May the second month in a row that the powertrain has seen numbers drop. This is also reflected in the market share. The 81,058 units represented 54.9% of the total registrations in the month, down from 57% a year earlier. However, petrol is still dominating, and is likely to do so for some time to come.

A potential cooling of interest is also reflected in the fact that May represented the second consecutive month of declines for petrol. In the first five months of 2024, the powertrain has increased its deliveries by 5%, yet this figure stood at 9.4% at the end of March.

Diesel continued its decline, down by 16.7% with 9,220 units delivered. This led the powertrain to a 6.2% market share, down by 1.4 percentage points (pp).

This means that in May registrations, ICE, including MHEVs, was down by 3.8% year on year. Their market share also fell, from a combined 64.6% in the same month last year, to 61.7%.

You must be logged in to post a comment.