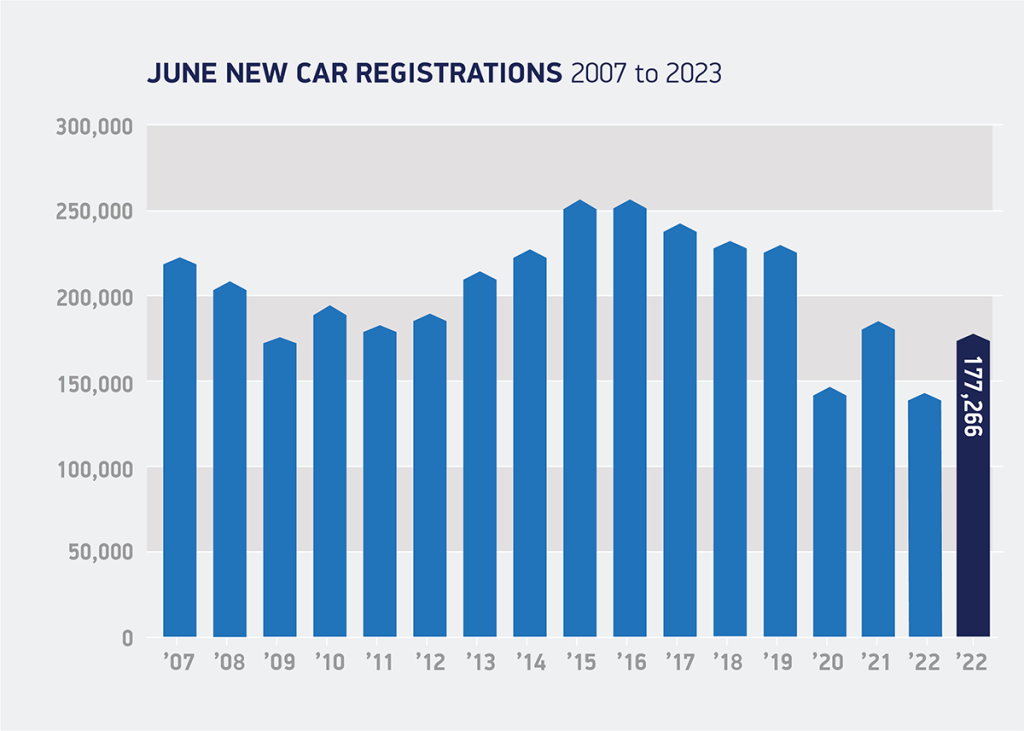

New-car registrations improved again in June as the automotive industry continues to recover from a supply-chain crisis that decimated the market in the wake of COVID-19.

Last month, registrations totalled 177,266 units, an increase of 25.8%, according to figures from the Society of Motor Manufacturers and Traders (SMMT). This is the 11th consecutive month of growth, but comes against significantly-reduced figures that ran until August 2022.

Therefore, it is likely the market will begin to stabilise in August and for the rest of the year. The supply-chain crisis saw a reduction in availability of crucial components used in automotive manufacturing, including semiconductors. This delayed deliveries, with some customers waiting more than nine-months for their vehicles. As the bottleneck eased, registrations rapidly grew, but as these figures catch up with themselves, growth will slow. However, the market is still likely to end the year up on 2022.

Overall, new-car registrations are up 18.4% across the first six months of the year. However, highlighting the work that needs to be done to fully recover from the disruption faced so far this decade, registrations are down 25.2% so far in 2023 when compared to 2019, with a drop of 20.7% in June alone.

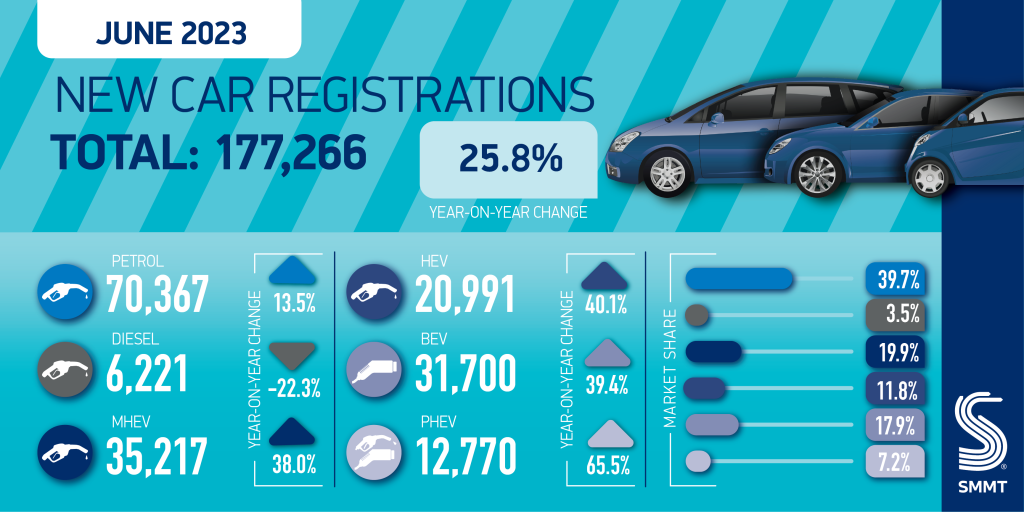

Growth in the month was driven predominantly by large fleet registrations, up 37.9% to 92,699 units, reflecting the normalisation of supply. Private demand grew more modestly, up 14.8% to 79,798 units.

Petrol and BEVs drive new-car registrations

Petrol remained the most popular drivetrain, with new-car registrations in June growing by 22.7% with 98,894 units (including mild hybrids) taking to the country’s roads, representing a 55.8% market share. In contrast, diesel cars saw a decline of 13.5%, although with the collapse of the market in recent years, this represented a total of just 2,012 fewer units compared to a year ago, a market share of 7.3%.

Battery-electric vehicles (BEVs) continued to shine, posting a 39.4% increase over June 2022, with 31,700 buyers moving to the technology. This means the powertrain remains the second most-popular fuel type in the UK, with a 17.9% market share.

Hybrid vehicles saw new-car registrations increase by 40.1% to a market share of 11.8%, while plug-in hybrids (PHEVs) increased registrations by 65.5% to take 7.2% of the market in June.

While the BEV numbers seem impressive, the SMMT highlighted that it was businesses and fleets that were responsible for their new-car registrations growth in June, rather than the private sector. The UK body believes that, while manufacturers are offering their own incentives to persuade drivers to make the switch, more could be done by other stakeholders, such as government and energy companies, to help drive change.

Zero-emission mandate target

The BEV market share for new-car registrations in 2023 is now 16.1% but, with a zero-emission vehicle mandate requiring 22% BEV registrations per manufacturer due to come into force in less than six months’ time, more needs to be done to accelerate the transition.

Given that recharging an electric vehicle (EV) at home can offer a 60-70% cost per mile saving compared with refuelling a petrol or diesel vehicle, the automotive industry is calling for a cut in VAT on public charging to help quicken uptake.

Drivers able to charge at home pay just 5% VAT to power up their EV, compared with 20% for those without access to a driveway or designated private parking space who are reliant on the public network. VAT equity would make switching to an electric vehicle feasible for more people regardless of home ownership or property status.

“The new-car registrations market is growing back and growing green, as the attractions of electric cars become apparent to more drivers,” Mike Hawes, SMMT Chief Executive, said. “But meeting our climate goals means we have to move even faster. Most electric vehicle owners enjoy the convenience and cost saving of charging at home but those that do not have a driveway or designated parking space must pay four times as much in tax for the same amount of energy.

“This is unfair and risks delaying greater uptake, so cutting VAT on public EV charging will help make owning an EV fairer and attractive to even more people.”

The SMMT has also released a new report, highlighting five key pledges that the future government needs to make in order for the UK automotive industry to deliver up to £106 billion to the country’s economy. This includes provisions to build green skills, as the industry, including the aftermarket, faces a crucial skills shortage.

You must be logged in to post a comment.