Despite being one of the strongest new-car markets in Europe last year, the UK has started 2025 poorly, with another month of registrations decline in February.

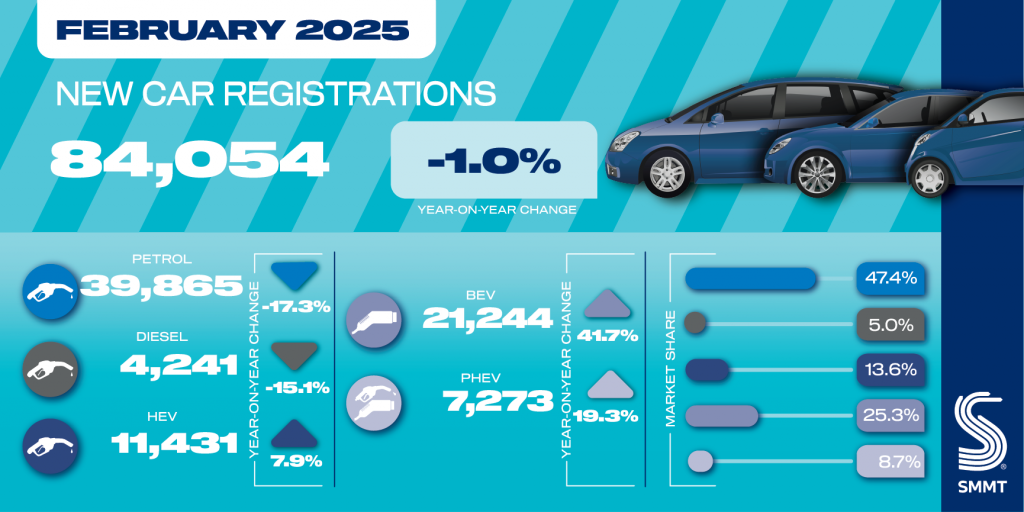

However, despite the 1% fall in deliveries, the sector still performed strongly. The latest data from the SMMT shows that 84,054 new cars were delivered to customers last month, a drop of 832 units compared to February 2024.

According to the industry body, last year saw the best February performance in two decades. This means the figures from last month had a tough act to follow. With disruption between 2020 and 2023, due to COVID-19 and supply-chain issues, when compared to February 2019, the market was up 2.5%.

February is usually the smallest-volume month of the year, with just 4% of the total yearly registrations.

Yet the decline was the fifth consecutive registrations drop. With January’s decline in deliveries, the result in February leaves the UK market down by 1.9% across the first two months of the year.

The UK was one of the most stable markets in Europe, with two years of growth between August 2022 and August 2024. Now, it is struggling, as regulation changes start to bite, with more problems ahead. This could affect both internal-combustion engine (ICE) and battery-electric vehicle (BEV) sales, which may, in turn, benefit the aftermarket.

ICE registrations slide

February’s slide was caused by declines in both the petrol and diesel markets. These two internal-combustion engine (ICE) powertrains were the only ones to see losses in the month, with the significant drop in petrol registrations alone causing the damage.

The fuel-type saw deliveries fall 17.3%, to 39,865 units. The SMMT combines petrol and diesel mild-hybrids with their respective fossil-fuel counterparts, meaning the powertrain still led the market in the month. But its market share of 47.4% was down by 9.4 percentage points (pp) against February 2024.

This result means that across the first two months of the year, petrol registrations are down 16.1%, with 109,940 registrations. The 49.2% share of deliveries is down 8.3pp.

Diesel registrations dropped 15.1% in the month, with 4,241 units. The technology’s market share fell by 0.9pp, to 5%. In the year to date, diesel figures are down 10.3%, with 12,866 deliveries. A market share of 5.8% is a decline from the 6.3% recorded at the same point in 2024.

Opportunities ahead?

These declines meant that in February, total ICE registrations in the UK fell by 17.1%. The technology still dominated the market with a 52.5% share of deliveries, but this fell 10.2pp compared to last year.

In the year to date, ICE registrations have dropped 15.5%, with a 55% market share, down from 63.8% recorded 12-months prior.

While ICE registrations have been in decline for some time, one possible explanation for their poor start this year is the updated targets in the UK’s zero-emission vehicle (ZEV) mandate.

For 2025, carmakers must ensure that 28% of their total registrations across the year are made up of ZEVs. With the current uncertain nature of BEV sales, manufacturers may be slowing the delivery, or removing from sale, certain ICE options. This would alter the balance of their fleets in favour of zero-emission models.

The new EU regulations on CO2 emissions targets may also be affecting things. Some marques may be reducing their petrol and diesel line-ups to aid their potential of meeting the stricter requirements. While not a member of the union, it is unlikely that brands will produce models specifically for the UK market.

If this is the case, it means that those wanting a petrol or diesel model will either hold onto existing vehicles for longer, or will turn to the second-hand market. This will, in turn, affect the UK car parc’s average age, pushing it upwards with fewer new models joining the ranks.

Therefore, with more older vehicles on the roads, more work is likely to enter the independent aftermarket. These vehicles have less ties to main dealerships, but will need more regular servicing as time goes on. This means that should the trend continue, the aftermarket, once again, has the chance to lead the UK automotive sector.

BEV changes looming

February’s numbers were helped by a significant rise in BEV registrations. The all-electric technology surged 41.7% in the month, with 21,244 deliveries. This was an improvement of 6,253 units year on year.

The result meant that BEVs took a 25.3% market share, up from 17.7% recorded at the same point last year. Therefore, one in four deliveries in February was an all-electric model.

This means that across the first two months of the year, BEV volumes have risen 41.6%, with 50,878 registrations. This is up by 14,952 units. In terms of market share, the technology holds 22.8% of total registrations, up by 7pp. This is above the 2024 ZEV mandate target of 22%, but still below this year’s threshold of 28%.

All-electric numbers are likely to increase again in March. This is because from April, BEVs will be subject to vehicle excise duty (VED). This is set at £10 (€12) for the first year of registration, followed by an annual charge of £195. Models registered before 1 April 2017 will only be subject to a £20 yearly payment.

However, BEVs with a list price above £40,000 will be subject to the expensive car supplement (ECS). This is paid yearly between the second and sixth year of a vehicle’s registration. According to the SMMT, this could add £2,125 to the cost of running a BEV over its first six years, on top of the additional VED charge.

Used-BEV push likely

For drivers who want to purchase a BEV, but do not want to pay the ECS, or even the higher rate of VED, the used-car market will become more attractive.

While there are not many models available from before 1 April 2017, there are some. But even so, second-hand BEVs will not come with the ECS requirement. Again, as in the case of petrol and diesel models, any increase in this market will likely feed back into the independent repair sector.

Yet in this case, the industry needs to be ready, with workshops requiring the correct tooling and training. Many BEVs will need the same servicing requirements as ICE models, with tyres, lighting, brakes and more needing replacement at some point in their lives.

With this in mind, 2025 could start to see more hybrid and electric vehicle repair requirements come the way of the independent aftermarket. It will be a trend to watch.

Hybrids high up

The UK’s PHEV market also had a strong month. Registrations increased by 19.3% compared to February 2024. A total of 7,273 deliveries gave the powertrain a market share of 8.7%, up 1.5pp year on year.

Meanwhile, HEVs improved by 7.9%, with 11,431 deliveries. This left the technology with a 13.6% share of registrations, up by 1.1pp.

Over the first two months of the year, PHEVs have seen a 10.1% improvement in numbers, with 1,829 more models taking to UK roads. This brings the year-to-date total to 19,871 units, and equates to an 8.9% share of total deliveries in the year. This is up 1pp on the same period in 2024.

For HEVs, figures have grown 4.8%, increasing the 2024 total to 29,844 units. The technology has a 13.4% market share, up from the 12.5% of January and February last year.

Combining BEVs and PHEVs, the electric vehicle market increased by 35.2% in February, taking a 33.9% share of the market, up 9.1pp. In the first two months of 2024, EV registrations have improved by 31.1%, for a 31.7% market share, up 8pp.

Adding HEVs to this total, the electrified marketplace grew 26.1% last month, with the total share of registrations reaching 47.5%, up 10.2pp.

You must be logged in to post a comment.