Latest data released by the Society of Motor Manufacturers and Traders (SMMT) shows another dramatic increase in registrations during May, although down on April’s meteoric rise.

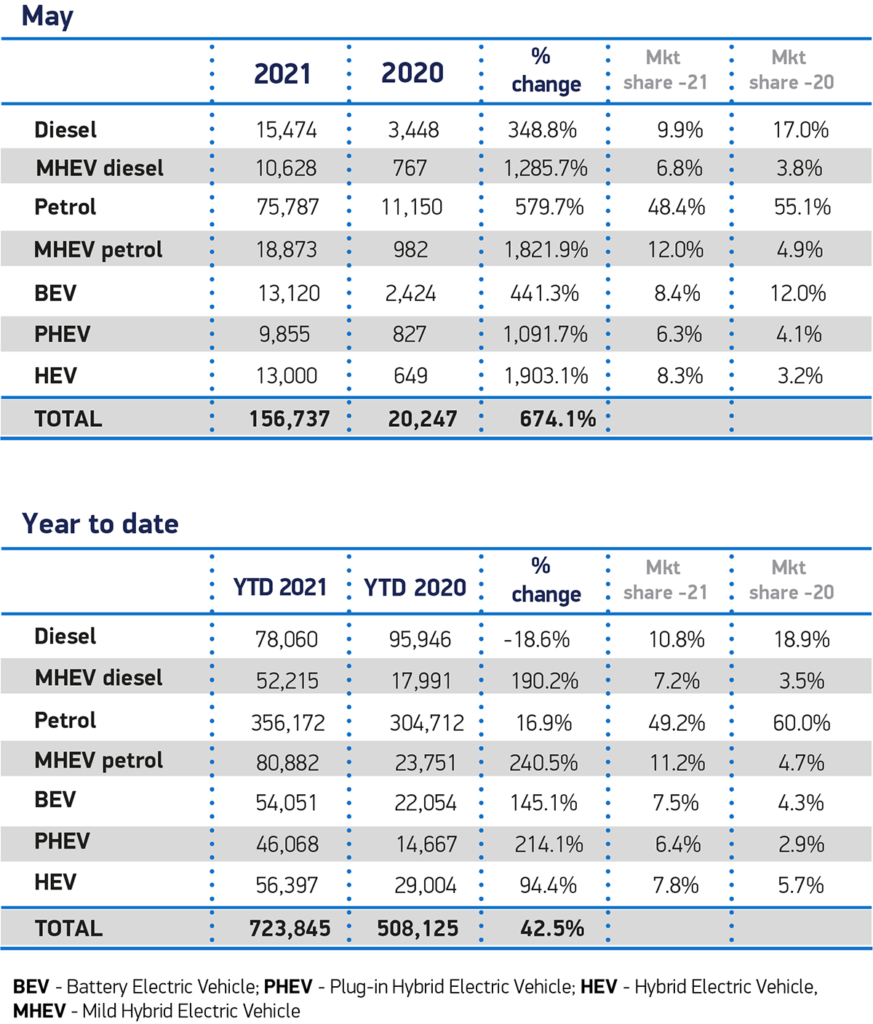

Last month, 156,737 new-cars were registered in the UK. This is up 674.1% compared to May 2020. However, these figures are distorted by the fact that showrooms were closed last year due to the COVID-19 lockdown. Therefore, to better understand the market, we need to look at 2019 figures. With this comparison, registrations were down 14.7%. The SMMT also highlighted that numbers were down 13.2% on the 10-year average for the month.

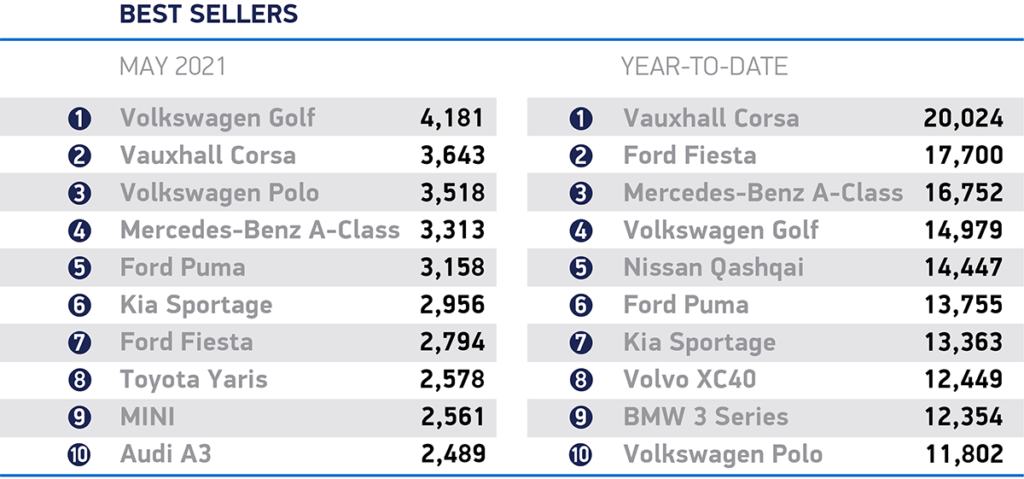

The SMMT expects sales to reach 1.86 million units by the end of the year, with 723,845 achieved so far. This would be up on last year’s 1.63 million registrations, but still substantially behind 2019, where 2.31 million vehicles were sold. It will not be until next year that the industry can really start to recover – as long as the vaccination programme succeeds and the economy begins to recover.

Fuel type

The battery-electric vehicle (BEV) market share declined from 12% a year ago to 8.4% in the past month, although the figures are distorted due to the variable purchasing options due to COVID-19 lockdowns. However, year-to-date, BEV sales are up 145.1%. This represents 54,051 new cars on the roads.

Looking more broadly across 2021, plug-in vehicles now comprise 13.8% of new car registrations, up from 7.2% a year earlier, with the most rapid growth seen in plug-in hybrid (PHEV) derivatives. Pure petrol and mild hybrid petrol cars so far account for 60.4% of registrations, while pure diesel and mild hybrid diesels took a 18.% share year to date, compared to 64.6% and 22.4% last year.

Diesel’s decline is more evident as the market recovers. Drivers and fleets are looking at alternative options, with hybrid and BEV more appealing in comparison to new diesel variants. Just 78,060 diesel cars have been registered so far in 2021, compared to 356,172 petrol. Hybrids with a petrol engine also outstrip pure-combustion diesels, with 80,882 models sold so far in 2021.

This is due to higher taxes and continued demonisation of diesel in the press since the Dieselgate scandal of 2015. While newer diesel models are not making it to roads, the technology is still popular, with used-car sales showing little slowdown for the fuel type. For the aftermarket, this means plenty of diesel work is likely to come into garages for some time yet, as these engines get older and older.

Averages down

Meanwhile, total registrations for 2021 sit at 296,448 fewer units, or 29.1% less, than the average recorded across January to May during the last decade, evidence of the scale of the recovery still needed given the impact of COVID on the market.

“With dealerships back open and a brighter, sunnier, economic outlook, May’s registrations are as good as could reasonably be expected,” said SMMT chief executive Mike Hawes. ‘Increased business confidence is driving the recovery, something that needs to be maintained and translated in private consumer demand as the economy emerges from pandemic support measures. Demand for electrified vehicles is helping encourage people into showrooms, but for these technologies to surpass their fossil-fuelled equivalents, a long-term strategy for market transition and infrastructure investment is required.”

Feature image: SMMT

You must be logged in to post a comment.