The UK new-car market dropped again in November, suggesting the sustained period of growth experienced for two years until August is well and truly over.

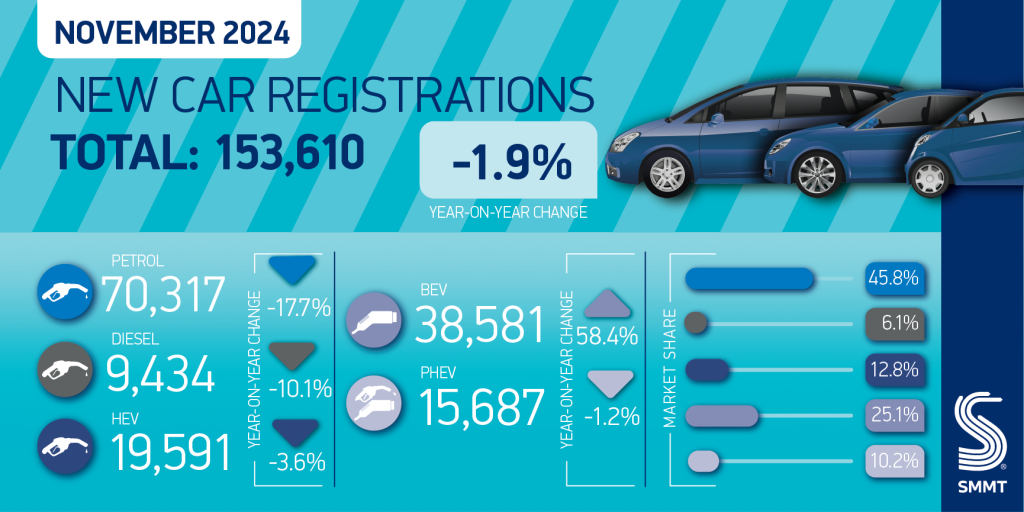

Registrations of new cars fell by 1.9% in November, with 153,610 units joining the roads across the country. The new data from the SMMT shows a second-consecutive monthly decline, and the third in four months.

The numbers in November may have been driven by the Zero-Emission Vehicle (ZEV) Mandate, which requires carmakers to ensure that 22% of all sales in 2024 are either battery-electric vehicles (BEVs) or hydrogen fuel-cell vehicles.

With a large number of carmakers struggling to reach this target, and some only in single-digit ZEV shares, this could have an effect on the registration figures to the end of the year. The SMMT highlights that heavy discounting has seen BEV deliveries increase, while the drop in petrol and diesel could be explained by manufacturers holding deliveries back, ensuring they do not take away from their ZEV totals.

The ZEV Mandate problem

The ZEV Mandate has proven a large problem in its first year, and the situation is only set to get worse.

For 2025, the mandate stipulates that 28% of passenger-car sales must come from zero-emission models. This rises each year to an 80% target by 2030, then on to 100% by 2025.

Carmakers that miss the required total face a fine of £15,000 per vehicle under the target. The current situation means that several brands are facing penalties of over £100 million, with one large OEM group potentially paying almost £500 million. The SMMT believes that total compliance costs, including purchasing credits from compliant carmakers, will cost the industry £1.8 billion this year alone.

This means manufacturers are likely trying to reduce the deficit to reduce potential penalties, the cost of credits, or the requirement to borrow from upcoming totals to offset their shortcomings this year. To do this, they can offer discounts on BEVs to push sales up, and hold onto deliveries of petrol and diesel, reducing their total fleet number for the year.

This may help to explain the instabilities in the new-car market at present. It may also lead to an increased number of BEVs on the roads in the coming months, with a further push into 2025 and beyond, unless the government relaxes the rules in its upcoming consultation.

BEVs pull up new-car market

BEVs were the only powertrain to record growth in November, with a 58.4% rise to 38,581 units. This highlights the efforts carmakers are going to in order to secure sales of the technology. The SMMT estimates the cost of discounting for the industry is around £4 billion.

This represents a 25.1% market share in the month. November was only the second time the new-car market has seen this figure above the 22% requirement.

In the year-to-date, BEVs are up 17.9%, with 338,314 registrations, an 18.7% share, well below the requirement in the ZEV Mandate. The SMMT believes that a continued push for sales could see the share rise to 19% by the end of the year.

“Manufacturers are committed to the mandate’s ambition, but market demand for EVs remains weak and below the levels expected when the regulation was drawn up by the previous government,” the SMMT commented.

“This year’s growth cements Britain as Europe’s second biggest new BEV market by volume and closing the gap on leader Germany. It reflects long-term manufacturer investment in new models, with more than 130 zero-emission choices now available – up more than 42% on a year ago,” it added.

Petrol decline continues

The new-car market in November saw petrol registrations plummet 17.7%, again suggesting deliveries are being held back. This was one of the steepest drops of the year so far, with 70,317 units taking to roads. The fuel-type still led the market with a 45.8% share of figures, but this was down from the 54.6% seen a year ago. In the first 11 months of the year, petrol is down 3.2% with a market share of 53%.

Diesel’s decline is not a new situation, and the 10.1% fall in November was based on a lower volume, meaning 9,434 new units were registered in the month, a 6.1% market share. So far in 2024, the fuel type is 12.6% down, with 116,044 deliveries.

This meant that the combined internal-combustion engine new-car market in November fell 16.9%.

To again highlight the push for BEVs, the full-hybrid new-car market also saw a drop in November. This has been one of the most reliable sectors this year, with many buyers preferring a hybrid model, and an increased line-up available from carmakers. The powertrain dropped 3.6% in the month, with 19,591 registraitons.

Finally, plug-in hybrids (PHEVs) also experienced a decline, albeit a small one of just 1.2%. The 15,687 new-car registrations was just 184 units lower than the same month last year. The drive type has seen deliveries increase 19.6% in the year to date,

Private declines again

New-car demand from private buyers, among whom uptake has waned for two years, dropped by 3.3% to 58,496 units, accounting for 38.1% of registrations in November. Across the first 11 months of the year, deliveries in this sector are down 9.1%.

Fleet purchases, which represent the bulk of the new-car market at 59.9%, fell by 1.1% to 91,993 units. In the year-to-date, the figures are 12.9% up, a move that should continue to interest the aftermarket.

“Manufacturers are investing at unprecedented levels to bring new zero-emission models to market and spending billions on compelling offers,” commented SMMT Chief Executive Mike Hawes. “Such incentives are unsustainable, industry cannot deliver the UK’s world-leading ambitions alone.

“It is right, therefore, that government urgently reviews the market regulation and the support necessary to drive it, given EV registrations need to rise by over a half next year. Ambitious regulation, a bold plan for incentives and accelerated infrastructure rollout are essential for success, else UK jobs, investment and decarbonisation will be at further risk.

You must be logged in to post a comment.