For the first time in two years, the UK new car market saw registrations drop last month, bringing to an end the longest streak of growth amongst the biggest markets across Europe.

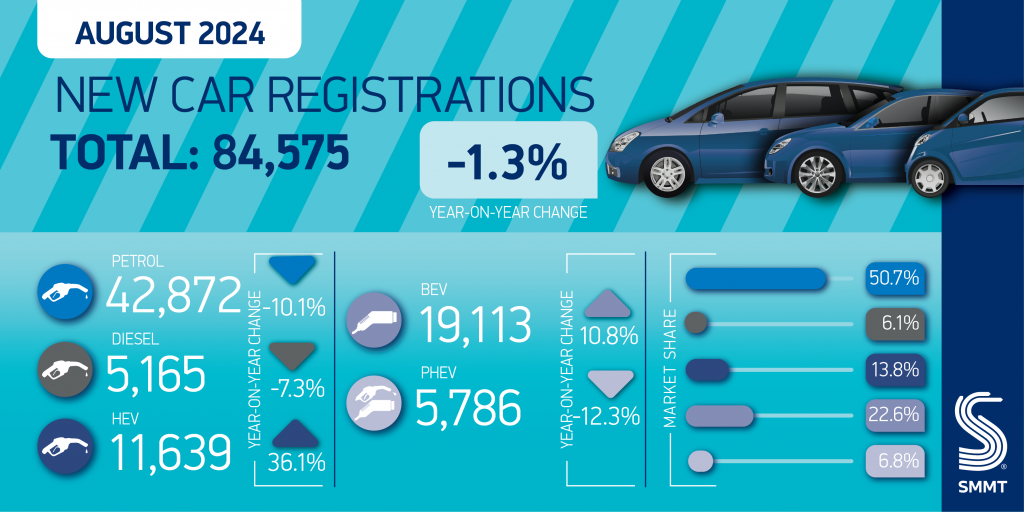

According to the latest SMMT data, in August, deliveries of new cars fell by 1.3%, with 84,575 units registered. This meant a difference of just 1,082 units. The UK new car market has been threatening to post a decline for the last four months, with the second quarter of the year experiencing a rapid slowdown. Therefore, the decline, in what is traditionally a slow month for registrations, is less of a shock.

With the 74-plate launching in September, many buyers often wait for their new cars to be registered then, taking advantage of the better residual values offered by what is perceived to be a newer model. With registration figures counting at the point of delivery, rather than the point of sale, this distorts the UK new car market. The decline in August, therefore, may only be a blip, rather than a trend.

Fleets drive UK new car market again

While all eyes may be on private registrations, it is the fleet sector that is of most importance to the aftermarket. These cars are most likely to enter the second-hand sector after three years, and at this point, with no ties to franchised dealerships or fleet networks, there is a greater chance of their new owners taking them to independent workshops.

Therefore, the SMMT UK new car market figures showing that fleet registrations accounted for six in 10 deliveries in August is good news. However, this was a 1.2% decline year-on-year. A total of 51,329 units went to the fleet sector, a 60.7% share of the market.

For the first time in 10 months, private registrations increased in August, albeit by 0.2% with 32,110 units. This was also the first time in two years that private registrations outpaced the fleet sector in terms of growth. This is not a trend that is likely to continue, with fleets most susceptible to the wait for new registration plates. Therefore, the trend of fleets leading both unit totals and growth is expected to recommence in September.

Business registrations were down by 30.3%, to 1,136 units. This market often posts lower numbers, but these will often be exchanged in three-years’ time as well, making this another market of interest.

BEVs improve as hybrids lead

Following months of slowing registrations, battery-electric vehicle (BEV) deliveries improved in August by 10.8%, with 19,113 units finding their way to new owners. These numbers are lower than the monthly average, with August being a slower period for registrations, but the figures show there is still demand, with much of the media suggesting otherwise.

The August figures meant BEVs took a 22.6% share of all registrations in the month, above the 22% requirement as part of the zero-emission vehicle (ZEV) mandate. This is also up by 2.5 percentage points (pp) compared to the same period last year.

But when it comes to the ZEV mandate, it is the year-to-date figure that matters to the UK new car market, while carmakers will have their own fleet shares to decipher. In the first eight months of the year, BEVs are up by 10.5% with 213,544 units registered. This is a 17.2% share of the UK new car market, up by 0.8pp.

BEVs remained the UK’s second-best powertrain in August, behind petrol. But in terms of growth, it was the full-hybrid (HEV) market that excelled last month, with a 36.1% rise. A total of 11,639 units entered the UK new car market, taking 13.8% of all deliveries. This was up by 3.8pp year-on-year. So far in 2024, HEVs are up by 17.9%.

Meanwhile, plug-in hybrids (PHEVs) struggled in August, with a 12.3% drop in deliveries, as 5,786 units took to UK roads. This left the powertrain with a 6.8% market share, down by 0.9pp compared to August 2023. The bridging technology has had a stronger year in 2024, with 100,457 units in the first eight months a 24.9% rise compared to last year.

Combined, electrified powertrains rose by 12.8% in the UK new car market during August, with a 43.2% market share highlighting a need for technicians to be trained in their upkeep. With these models alone likely to enter the independent sector in three years, and many more coming, the requirement will only continue to rise.

Petrol decline continues

While it continues to lead the market in terms of volume and share, petrol has had a rougher run in 2024, and August saw a significant decline in registrations. A total of 42,872 units were delivered, down by 10.1% compared to the same month last year. This is the likely cause of the overall UK new car market decline in the month, with 4,816 fewer models a gap too far for other powertrains to fill.

With declines over recent months, this latest result leaves the year-to-date figure for petrol models at 674,312 units, up by just 0.8% after eight months of the year. The fuel-type’s market share dipped dramatically as well, with a 50.7% hold in August down by 5pp, while in the year to date, it has a share of 54.4%, still commanding, but having dropped by 2.2pp.

Diesel continued its slide and was the lowest volume powertrain in the UK new car market during August. Just 5,165 units were registered, a fall of 7.3% year-on-year, while between January and August, 80,093 units is down 13% compared to the same period in 2023.

“August’s EV growth is welcome, but it is always a very low volume month and so subject to distortions ahead of September’s number plate change,” commented SMMT Chief Executive Mike Hawes. “The introduction of the new 74 plate, together with a raft of compelling offers and discounts from manufacturers, plus growing model choice, will help increase purchase consideration and be a true barometer for market demand.

“Encouraging a mass market shift to EVs remains a challenge, however, and urgent action must be taken to help buyers overcome affordability issues and concerns about charge point provision.”

You must be logged in to post a comment.