January new-car registrations started 2022 on a positive note, although a deeper look at the latest figures from the Society of Motor Manufacturers and Traders (SMMT) reveal little to be pleased about.

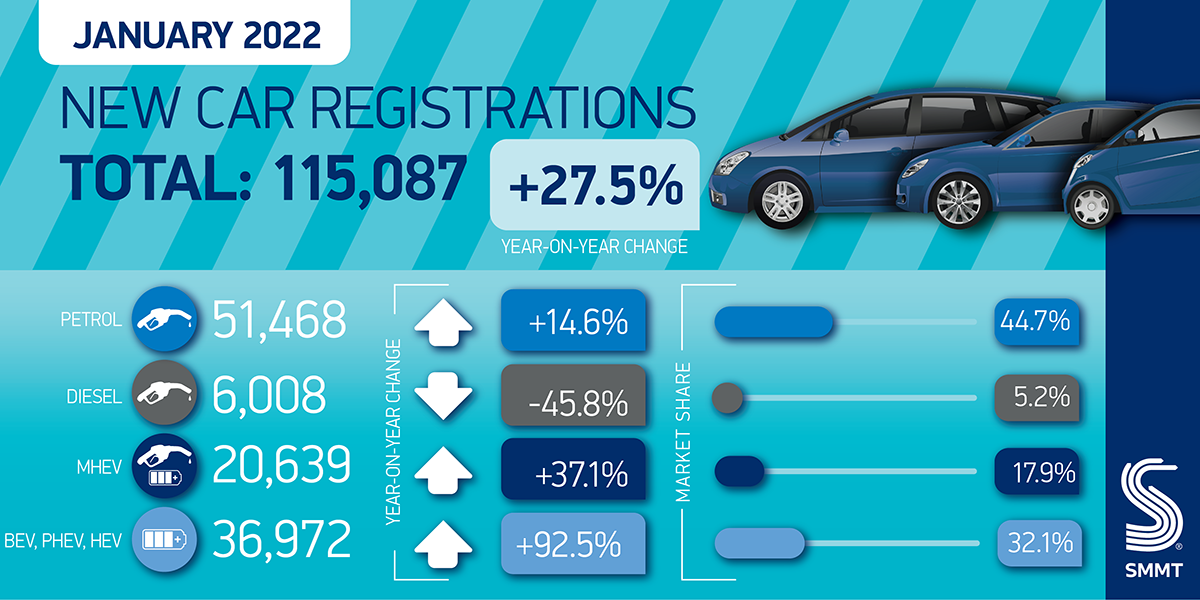

In total, 115,087 new cars were registered in January, up 27.5% on the same month in 2021. While in the past this would be hailed as a mighty success, this time last year many dealers were closed due to lockdown restrictions. When compared to January 2020, numbers were down 22.9%.

Electric vehicles (EVs) continue to provide the market with growth. Battery-electric vehicles (BEVs), plug-in hybrids (PHEVs) and hybrids (HEVs) accounted for 71.5% of the rise in registrations last month, according to the SMMT. A total of 14,433 BEVs and 9,047 PHEVs registered, equal to around 20.4% of the market. With 13,492 HEVs also registered, almost one in three new cars joining British roads in January was electrified.

“Given the lockdown-impacted January 2021, this month’s figures were always going to be an improvement,but it is still reassuring to see a strengthening market,” said SMMT chief executive Mike Hawes. “Once again it is electrified vehicles that are driving the growth, despite the ongoing headwinds of chip shortages, rising inflation and the cost-of-living squeeze. 2022 is off to a reasonable start, however, and with around 50 new electrified models due for release this year, customers will have an ever greater choice, which can only be good for our shared environmental ambitions.”

Supply constraints

It is not just the ongoing COVID-19 pandemic that is causing these wild fluctuations in the market. While consumer confidence is taking time to adjust to the ‘new normal’ when it comes to big ticket items, the automotive industry is experiencing a different crisis. The supply of semiconductors, a key component in many vehicle systems, has slowed dramatically in the last 12 months. Carmakers are shutting down production on some models and slowing output in order to cope.

The industry is competing with other technology markets for semiconductor ‘chips’, with a surge in demand for gadgets during the most severe times of the pandemic causing a bottleneck. The automotive market is not the leading concern for semiconductor producers, with sales of games consoles and computers, mobile phones and tablets and other technological products outstripping the volume of new vehicles. Therefore, carmakers are having to offer longer lead times on new vehicles, stunting supply and affecting registration figures.

January new-car registrations growth was driven by private buyers, as manufacturers sought to prioritise these customers given the supply constraints, with this segment of the market registering 62,300 new cars, up 64.1%, year on year, and just 5.6% down on pre-pandemic levels. Large fleet registrations, meanwhile, remained broadly flat with last year at 50,817 units (down 0.4%).

Falling CO2 levels

New data also shows that average new-car CO2 emissions fell by 11.2%, to its lowest ever recorded level of 119.7g/km in 2021.

There are now more than 140 plug-in car models available to UK buyers, with almost 50 more scheduled for release in 2022. Cutting CO2 even further, however, will require more drivers to switch to electric and other zero-emission technologies. One of the obstacles remains perceptions of a lack of charging infrastructure, which must be built ahead of demand, and that demand is increasing exponentially. Furthermore, as manufacturers strive to bring down the costs of these new technologies, government support through purchase incentives and reduced motoring taxes can help accelerate the take-up so that the road transport sector can meet society’s net-zero timeline.

This will also be good news for many carmakers, with regulations stating that they needed to achieve an average CO2 emission level across their fleets. The industry average target was 95g/km. However, targets are tougher for 2025, while the UK government has mandated that by 2035, only zero-emission new vehicles can be sold in the country.

Tough times ahead

The SMMT’s latest market outlook forecasts registrations of BEVs and PHEVs to grow by 61% and 42% respectively in 2022, meaning that by the end of the year, one in four new vehicles will come with a plug.

Overall, total new car registrations are expected to rise 15.2% on 2021, to 1.9 million units. This is a downward revision from October’s outlook of 1.96 million, as the ongoing semiconductor shortage, increasing costs of living and rising interest rates are expected to dampen some demand in 2022. A 2022 market of 1.9 million would still be down 17.9% on the pre-pandemic 2019, but the recovery is expected to continue into 2023, with the market projected to climb above two million units for the first time since 2019. With this in mind, January new-car registrations are on the right path for growth this year.