For the 20th consecutive month, new-car registrations in the UK recorded growth, bucking a trend seen in other major European markets.

According to SMMT data, registrations in March 2024 benefitted from the numberplate change, with the new 24 plate available to buyers. This helped the market see its best performance in the third month of the year since 2019.

While private registrations in March faltered, declining by 7.7%, importantly for the aftermarket, the growth was driven by fleets. Deliveries to larger companies were up by 29.6%. Smaller businesses saw numbers decline by 8% in the month. This highlights that the current cost-of-living crisis is still affecting the market, with only the larger businesses able to restock their fleets.

While this shows a market that is struggling, and perhaps waiting for its first decline in over a year, for the independent aftermarket this is good news. Private buyers are more likely to hold on to their cars after three years, whereas a majority of larger companies will defleet after this time. At this point, the used-car market will be flooded with affordable models, that have no ties to franchised dealerships.

Fleet registrations increase

UK private registrations dropped 7.7%, while those to small businesses, based on traditionally low volumes, fell by 8%. Deliveries to fleets improved by 29.6%, continuing a trend of leading registrations growth that began in February last year.

In the first quarter of the year, the fleet market is up by 28.9%, with a market share of 59.8%, up by 8.6 percentage points (pp) over the first three months of 2023. The private sector is down by 9.6%, with a share of 38% (down from 46.2% in the same period last year), while the business market is down 7.7%, with just 2.2% of the market.

The fleet market has driven the UK new-car market for some time, and registrations in March show a continuation of this trend. With every new vehicle registered, one is often dispatched to the used-car market, meaning an increasing fleet tally is good news for independent garages.

Petrol leads registrations in March

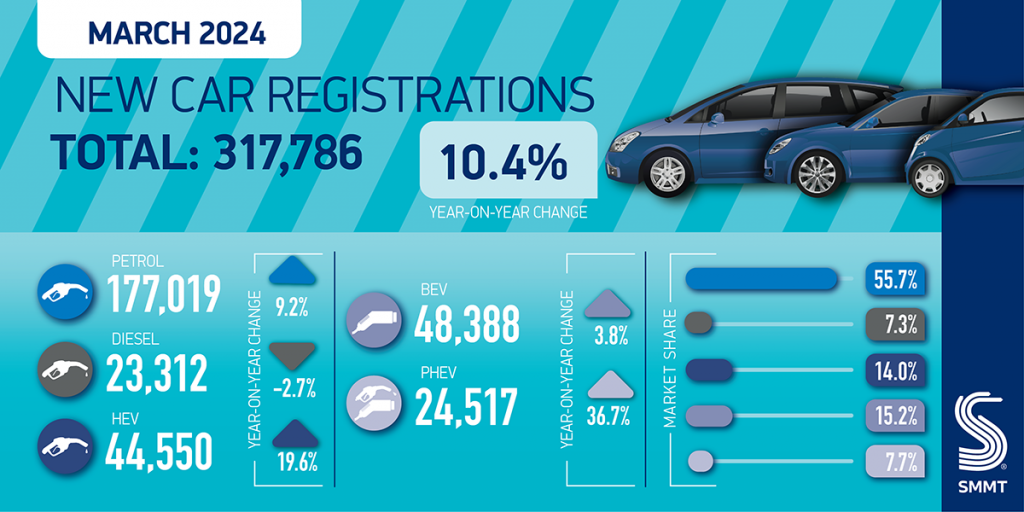

Once again, the dominant fuel in the UK was petrol, which led registrations in March thanks to a 9.2% increase. This meant 177,019 units took to the roads, representing 55.7% of all deliveries in the month.

The SMMT combines mild-hybrids (MHEVs), which cannot travel any distance on electric power, in with their respective fuel types. This can distort the figures when comparing to other European markets, which either spin out MHEVs into their own category, or combine them with full hybrids (HEVs).

Nevertheless, registrations in March show the market is still embracing petrol. Yet it is not doing so with its internal-combustion engine counterpart, diesel. The power train fell 2.7% in the month. While this might suggest a slowdown in the diesel collapse, just 23,312 units were registered, the lowest total of all propulsion technologies, and just 7.3% of the market.

The slowdown in diesel registrations in March may again provide an opportunity for the aftermarket. Without new registrations, the used-car market will lack supply. With this market having seen large numbers of diesel transactions, there is still an apparent demand for the powertrain, but those who want the engine type may be forced to hold on to their models for longer. This will mean an increased need of diesel servicing.

Electric market slows

Registrations in March showed that the battery-electric vehicle (BEV) market has slowed. Volumes of BEVs were at their highest ever levels, with 48,388 units leaving showrooms in the month. However, this only equates to a 3.8% increase for the powertrain, while its market share has fallen year on year, currently sitting at 15.2%. This is down 1pp from the same point last year.

BEVs have had something of a rollercoaster ride in the UK market in recent months. Not counting the declines in November and December, March’s performance marked the lowest growth for the technology ever.

Following the difficult end to 2023, both January and February saw registrations improve by 21% and 21.8% respectively. However, this may have been due to carmakers holding on to some deliveries that were due in the last months of 2023. Once registered this year, they would count towards their 22% target as part of the zero-emission vehicle (ZEV) mandate, which came into force from 1 January.

Looking at registrations in March, it now appears that the delaying tactics may have ended, and the market has reached its natural state. BEVs have now entered a tricky phase, as manufacturers need to win over drivers who are more sceptical about the all-electric powertrain. Coupled with a charging infrastructure that is still unable to meet the requirements of the mass-market, and higher list prices for new BEV models, and the challenge is clear to see.

Hybrids on the up

Full-hybrid vehicle (HEV) uptake reached record levels of registrations in March, with a 19.6% increase equating to 44,550 units. This helped the technology take a 14% market share. Across the first three months of the year, HEVs have improved their deliveries by 12.5%, with a 13.6% market share only marginally better than the first quarter of 2023 (13.3%).

The best performance of the month was seen by PHEVs. Registrations improved by 36.7%, albeit on lower totals, with 24,517 units. However, this was enough to push their market share up by 1.5pp to 7.7%. At the same point last year, the powertrain was some way behind diesel, and languishing at the bottom of the powertrain charts. This year, it is ahead of its ICE rival, although still some way behind HEVs, BEVs and petrol markets.

In the year-to-date, the market is up by 34%, equating to 42,559 units taking to the roads. This gives the powertrain a 7.8% market share, up by 1.4pp.

You must be logged in to post a comment.