The UK experienced a turbulent year of new-car registrations in 2024, with challenges for carmakers when it came to powertrain technologies. The introduction of the zero-emission vehicle (ZEV) mandate, and changing attitudes about petrol models, meant that the last half of the year saw overall figures fall.

The latest data from the UK’s automotive industry body, the SMMT, shows that deliveries fell 0.2% in December, with 140,786 units registered. This is just 306 passenger cars lower than the total from the same period in 2023. It was, however, the third-consecutive month of decline in the UK, the first time this has occurred since July 2022.

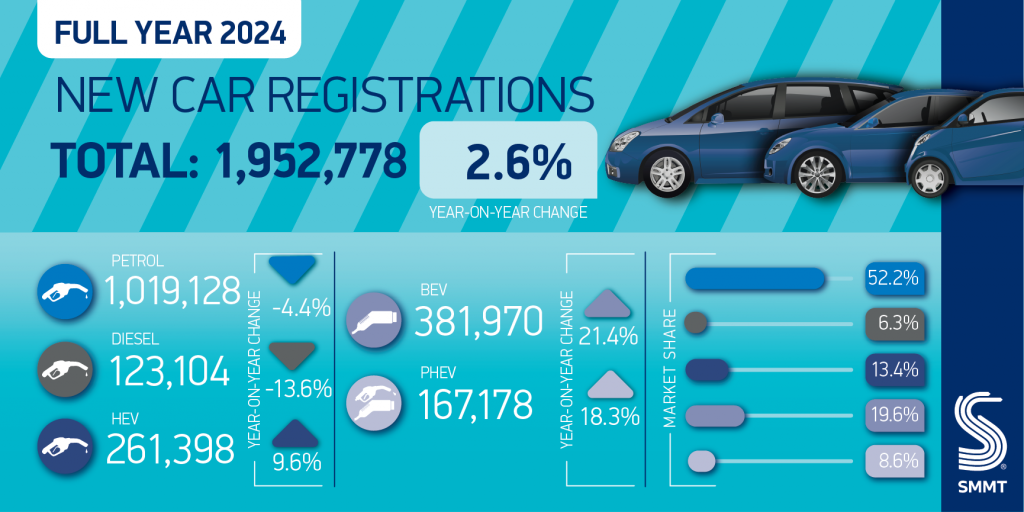

The small difference did little to affect the full-year total, which ended up by 2.6%, with 1.95 million units registered. At the halfway point of 2024, the figures were up by 6%. But following the UK’s first monthly decline in two years during August, a further three drops in October, November and now December have ended the year on a sour note.

This year could be more bring more challenges. Shifting attitudes towards internal-combustion engine (ICE) models, another shift in the date for new petrol and diesel car sales to be banned, and a consultation on those proposals and the ZEV mandate, mean the industry faces an uncertain few months.

BEVs bounce

December saw battery-electric vehicles (BEVs) achieve 43,656 registrations, up by 56.8% year on year. This meant the technology achieved a 31% market share in the month, the highest since December 2022, when models made up 32.9% of deliveries.

This meant that BEVs ended the year with 381,970 registrations. The figure was 21.4% up on the full-year figure for 2023, and represented 19.6% of the overall market, up by 3.1pp from 2023. Despite reports of a slowdown, the market has progressed well, and is the second most-popular powertrain type in the UK.

However, while impressive, there are likely tactics at play to achieve this result. The SMMT has highlighted that manufacturer discounting has totalled more than £4.5 billion. In December, it is also possible that some carmakers pushed BEV deliveries out as quickly as possible, to ensure they were registered in 2024.

This is backed by the improvement in BEV registrations in the last two months, with December’s rise following a 58.4% improvement in November, as carmakers raced to meet the target requirement.

ZEV mandate manipulation

The end of the first year of the ZEV mandate is a reason for this. In 2024, a total of 22% of a carmaker’s fleet had to be either all-electric, or hydrogen fuel-cell based. With fines of £15,000 per vehicle under the required target, several brands were facing significant financial penalties.

This may have impacted the final numbers of the year. In addition to pushing BEV deliveries to ensure they were registered in 2024, some carmakers may have held back deliveries of petrol, diesel, plug-in hybrid (PHEV) and full-hybrid (HEV) models.

The extent of any holdbacks would not be seen until January’s registration figures. Yet this could count against carmakers in 2025, when the ZEV mandate target increases to 28%. But increasing BEV fleet numbers while not adding to figures of any other powertrains would help improve shares for 2024, limiting chances of fines.

However, the SMMT remains cautious over the potential of penalties. It states that while average new-car CO2 fell by 6.2% to 102.1g/km, the extent to which it will help will remain unclear until confirmed baseline CO2 figures are provided by government.

Yet a spokesperson for the Department for Transport commented: ‘Thanks to the flexibilities in the ZEV mandate, we are confident the whole market has complied with the 22% target and that no car manufacturer will need to pay fines.’

Fleets drive BEVs

The SMMT highlighted that one of the major constraints to growth in the BEV market was lacklustre demand by private buyers, with only one in 10 choosing an electric vehicle (EV) in 2024.

Petrol remained the most popular powertrain among these buyers, commanding 61% of demand, with full hybrids (HEVs) in second place, with 16% of demand.

Conversely, around 64,000 more BEVs were registered by businesses and fleets than a year ago, with such vehicles representing 25.4% of those segments’ registrations and demonstrating the effectiveness of the compelling tax incentives afforded non-private buyers.

With the fleet sector making up 59.6% of the total market, this has likely helped carmakers when it comes to achieving the ZEV mandate target. However, it will take more effort to make BEV powertrains appeal to private buyers, with investment needed in charging infrastructure, and support for carmakers to remove needs for discounting.

For the aftermarket, these figures are significant. As fleets often sell their vehicles on before the first MOT, a large number of BEVs are soon to hit the used-car market, where they will likely enter independent workshops for servicing. Therefore, while the private uptake is slower, continued ties with dealerships make it less likely for these models to enter workshops. It is the fleet sector which is of most interest.

‘A record year for EV registrations underscores vehicle manufacturers’ unswerving commitment to a decarbonised new car market, with more choice, better range and increased affordability than ever before,’ commented SMMT chief executive Mike Hawes.

‘This has come at huge cost, however, with the billions invested in new models being supplemented by generous incentives which are unsustainable. We need rapid results from the regulatory review and urgent substantive support for consumers, else automotive investments will be at risk and the jobs, economic growth and net zero ambitions we all share in jeopardy.’

Plans under consultation

The ZEV mandate has caused many headaches for carmakers in 2024, with sales of BEVs slowing throughout the year. In December, the UK Government announced a consultation, part of which would look at the mandate and its effectiveness in helping towards the country’s zero-emission transition.

While the consultation does not imply that the target increases will change, it does ask about the flexibilities currently in place, and their time limits. This includes the ability to borrow credits in 2024, 2025 and 2026, and to convert any difference in CO2 baseline figures to offset ZEV targets in the same years.

‘Over the first year of the ZEV mandate, pressures on vehicle manufacturers have emerged that present additional challenges compared with when the original mandate design was consulted on. As a result, it is appropriate to seek views on whether the current flexibilities are still fit for purpose in meeting the existing ZEV trajectory, the phase out date for new cars that rely solely on an internal combustion engine in 2030, and the phase out of new non-zero emission cars and vans from 2035,’ the document states.

Amending the ban

The government has also confirmed that it will be bringing the UK ban on sales of new petrol and diesel engines back to 2030. This follows plans by the previous government to extend this deadline to 2035, banning all non-ZEV models at the same time.

The consultation launched in December is also seeking views on which new cars could still be sold between 2030 and 2035, when the ZEV-only rule comes into effect.

‘The consultation is an opportunity to consider stakeholders’ preferences on technology choices and the types of vehicles permitted between 2030 and 2035 alongside ZEVs,’ commented Heidi Alexander MP, secretary of state for transport.

‘It commits to maintaining the trajectories in the ZEV mandate while considering how the current arrangements and flexibilities are working and what steps can be taken to support domestic manufacturing and cement the UK’s position as one of the major European markets for ZEVs.

Options include establishing a CO2 emissions cap. Yet setting this at the level of the lowest-emission ICE cars could rule out most HEVs and significant proportion of PHEVs. A fleet-wide non-ZEV emissions cap could be introduced, giving carmakers a new target between 2030 and 2035. Or a simple rule allowing only PHEVs that emit less than 115g/km of CO2 could be considered.

The consultation, which is open to responses until 18 February, does mean a further delay for carmakers to develop their model plans for the years ahead. This will be the fourth time the non-ZEV new-car ban has been amended. It was first announced in 2017, with a target date of 2040. In 2020 this was brought forward to 2030, before its push back to 2035, which was confirmed during 2023.

Petrol problems

The BEV tactics meant petrol registrations, which includes pure and mild-hybrid petrol engines, suffered their biggest decline since June 2022. December saw a 20.9% drop in deliveries, with 59,455 units taking to UK roads.

This gave petrol a market share of 42.2%, a drop of 11.1pp compared to the same month in 2023.

The performance meant the fuel-type ended the year with a decline of 4.4%, as drivers shifted away from fossil-fuel vehicles towards cleaner alternatives. However, with just over one million registrations, petrol was still the most dominant powertrain in the UK, with a market share of 52.2%. This was also down compared to the full year of 2023, but only by 3.8pp.

Diesel, meanwhile, sank further into the distance from other powertrains. Just 7,060 units were registered in December, a 27.4% decline. This gave the powertrain a 5% market share, dropping 1.9pp on December 2023.

In the full year, diesel registrations fell 13.6% with just 123,104 units taking to roads. This was 6.3% of all registrations in the UK, a fall of 1.2pp, and the lowest share of all powertrains.

Combined, the effect of holding back some registrations meant ICE deliveries fell by 21.6% in the month, while in the full year, figures were down 5.5%.

Hybrids hang in

HEVs saw a 10.4% increase during December, with 17,899 units delivered to customers. This gave the powertrain a 12.7% share of the market in the month, up from the 11.5% recorded in the same period of 2023.

For the whole of 2024, HEVs saw an increase of 9.6%, with 261,398 models delivered. This meant the powertrain was the third-most-popular in the country, with a 0.9pp rise in market share to 31.4%.

PHEVs also saw an increase in December. However, the 4.6% rise equates to just 554 more units, with a total of 12,716 cars delivered. This meant the technology gained a modest 0.4pp on its December 2023 market share, to end the month at 9%.

In the full year, PHEVs achieved 167,178 registrations, up 18.3%. This meant the technology took 8.6% of the market, up from the 7.4% recorded across the whole of 2023.

You must be logged in to post a comment.