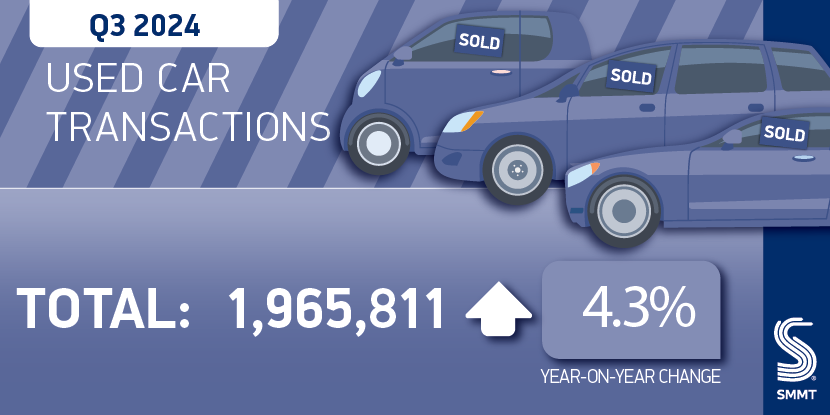

The UK’s used-car market improved by 4.3% between July and September, as drivers continue to look towards older cars for their next vehicle purchase.

A total of 1,965,811 passenger cars changed hands in the third quarter, according to data from the SMMT. This equated to 81,651 additional transactions compared to the same period in 2023. This is in contrast to the new-car market, which only saw growth of 1% in the same period, an additional 5,143 units.

As the UK’s new-car market has slowed and struggled in recent months, including declines in August and October, the used-car market has remained steady across the year. However, the third quarter’s growth is the lowest of the year so far, following a 6.5% improvement in Q1, and a 7.2% rise in Q2.

The figures show, however, that the appetite for newer cars is still there amongst buyers. Yet the desire for a brand-new model is on the wane. This is good news for the aftermarket, and with fleets driving new-car registrations at present, figures should continue to be positive for used-car sales in the years ahead.

Improvement in used-car market

Unlike the new-car market, every month of 2024 has seen an improvement in used-car transactions, confirming the sector’s strength. Although growth in the third quarter was the lowest so far this year, this is because the numbers were so strong in comparison.

July saw 668,890 transactions, up 3.5% year on year. This was the fourth highest tally of 2024 so far, and it was beaten into third place by August, when 669,243 used cars were sold, up 4.5%. Both months are behind April and May in terms of volumes. Finally, September saw 627,768 cars change hands, growth of 5% against last year.

The used-car market is now on its strongest performance across the first nine months of the year since 2019.

In contrast, the new car market saw a rise of 2.5% in July, followed by a decline of 1.3% in August, and then a small bounce back of 1% in September. With the cost-of-living crisis still playing on many people’s minds, and an increasing number of newer models available in the used-car market, buyers are turning their backs on new vehicles.

BEVs improve but petrol leads

A record 53,423 used battery-electric vehicles (BEVs) found new owners in the quarter, a rise of 57% compared to the same period last year. This helped the technology achieve its highest-ever used-car market share, with 2.7% of transactions. This is up from the 1.8% recorded between July and September last year.

Sales of plug-in hybrids (PHEVs) and hybrids (HEVs) also rose, up 29% and 35.8% respectively. The sales of used electrified vehicles, especially BEVs, is likely to increase in coming years. Since 2021, there has been a larger uptake of these models in the new-car sector, many of these from fleet buyers.

With fleets likely to change their line ups every three years, this means that an increased number of BEVs, PHEVs and HEVs are going to enter the used-car market. Many buyers who are put off by the higher new prices of these models will look at the cheaper alternatives. As many BEVs struggle to retain half their value after three years and 36,000 miles, they are considerably cheaper than new cars, but will require aftermarket help to keep them roadworthy.

Petrol powers ahead

However, petrol still led the way in the used-car market during the third quarter of the year. A total of 1,123,387 transactions were recorded, up 5.7% and recording a market share of 57.1%.

Diesel sales were down by 3.9%, more due to a lack of supply than a lack of interest. With diesel vehicles often performing strongly for longer, many drivers will hold on to them. In addition, sales of new diesels have declined rapidly, reducing the number of models available in the used-car market.

Together, petrol and diesel sales dominated the used-car market in the third quarter, with 91.7% of all transactions. While electrified vehicle sales will continue to rise, it will take them some time to catch up to traditional powertrains.

“Growth in the used car sector is good news and driven by an outstanding range of desirable and, increasingly, zero-emission vehicles to suit every budget,” commented SMMT Chief Executive Mike Hawes. “Maintaining this depends on a healthy new car market, particularly for EVs.

“Giving consumers the confidence to switch from their familiar petrol or diesel vehicles requires confidence and incentives otherwise many would-be new car buyers will sit on their hands, leading to a diminishing market that will inevitably limit used car availability and affordability. This will be to the cost of motorists, the economy and the environment – making a review of support for the transition and the regulation intended to deliver it, an urgent priority.”

Back to black

Black remained the best-selling used car colour, accounting for 21.2% of all transactions. Unchanged from the same period last year, grey took second place, growing by 7.9% to 17.6% of sales, followed by blue, up by 2.8% and making up 16.1% of the market. Silver was the only colour in the top 10 to see volumes fall, slipping to fifth place.

Superminis retained their long-standing popularity, with sales increasing by 5% to 637,865 units to make up 32.4% of all transactions. Lower medium (up 5.5%) and dual purpose (up 10.5%) cars came second and third, accounting respectively for 27.1% and 15.8% of the market.

Combined, the top three represented more than three quarters (75.3%) of all used cars changing hands. Meanwhile, the upper medium, executive, MPV, mini and luxury saloon segments recorded falls.

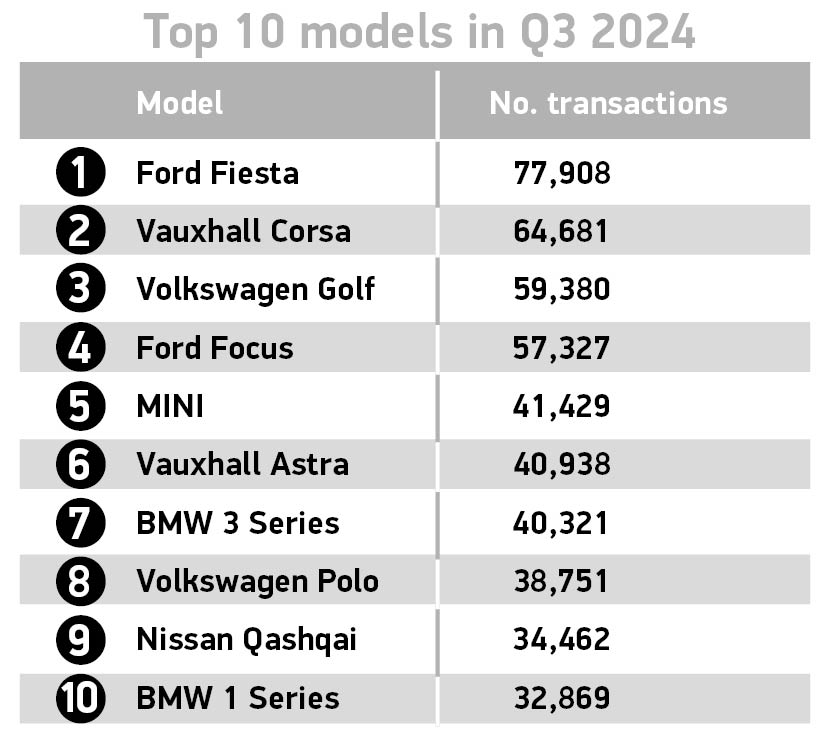

Finally, the Ford Fiesta once again topped the UK used-car market in the third quarter of the year, with 77,908 transactions. This is an impressive result for a car that is no longer available to buy new, suggesting that Ford may have been premature in removing it from sale. The Vauxhall Corsa came second, with 64,681 sales, with the Volkswagen Golf and Ford Focus in third and fourth positions.

You must be logged in to post a comment.