The UK used-car market recorded a third-successive quarter of growth at the end of September, according to figures released by the Society of Motor Manufacturers and Traders (SMMT).

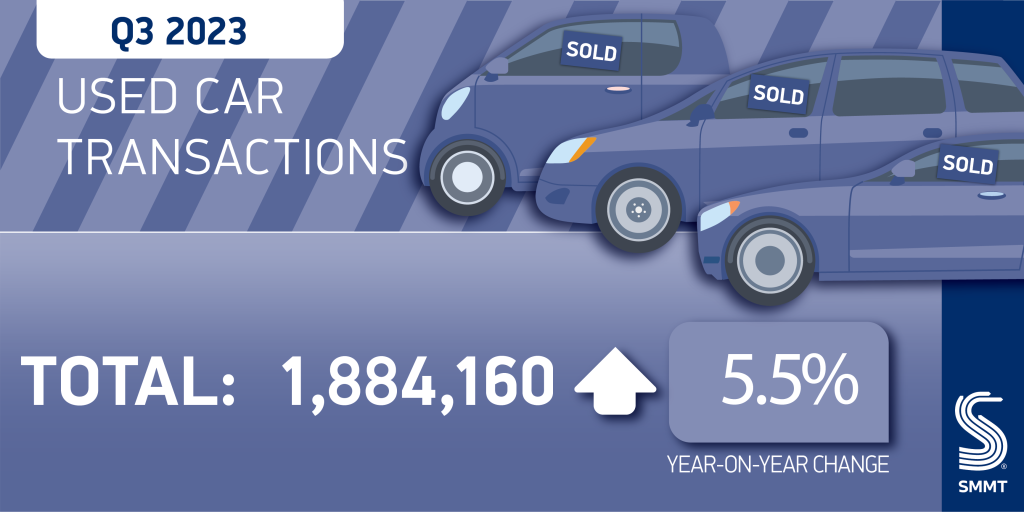

The latest data shows an increase in transactions of 5.5% between July and September, with 1,884,160 units changing hands. This means an extra 98,713 cars were sold in the three-month period, highlighting an increase in both supply and demand for UK used cars.

Volumes in each month of the quarter rose, with the strongest gain in September, up 6.3%, which helped the market deliver the best Q3 performance since 2021. The following 15 months were blighted by issues in the new-car market, which impacted the UK used-car market too. While registrations dropped due to a supply-chain crisis, buyers were either forced, or decided, to hold onto their cars for longer. This meant fewer cars entering the used market, which had a knock-on effect on sales.

As a result, the overall UK used-car market is up 4.6% to 5,563,576 units year to date, an increase of 244,094 units on 2022, although uptake remains 9.3% off pre-pandemic levels.

Electric increase in UK used-car market

Reflecting an increase in supply, the demand for battery-electric vehicles (BEVs) almost doubled in the quarter, with 34,021 transactions up 99.9% on the same period last year.

“The UK used-car market continues to grow strongly, with re-energised supply unlocking demand for pre-owned electric vehicles, the result being twice as many motorists switching to zero emission motoring in the quarter,” commented SMMT Chief Executive Mike Hawes.

“Maintaining this momentum requires growth in the new car market, to boost supply to the used sector and cement this success. Equally important is the urgent need for charging infrastructure rollout so that all drivers can have confidence in being able to charge whenever and wherever they need.”

BEVs held 1.8% of the market share in the quarter, which may not sound like much, but is still up 0.8% over the same point last year. With the majority of BEV transactions coming from ex-fleet models, this makes more sense. On average, companies will de-fleet after three years, with these models entering the UK used-car market. However, in 2020, the market was still in a state of flux, with COVID-19 cases rising and lockdowns impacting deliveries. Once this cleared, another crisis, the aforementioned supply-chain crisis, also impacted deliveries.

It should also be remembered that registrations of new BEVs only started increasing just after the pandemic. Therefore the 34,021 transactions in three months likely represents nearly all used-BEVs on the market in that period. While new models are inherently expensive, a BEV on the UK used-car market will be cheaper, giving buyers an opportunity to experience zero-emission motoring.

Sales of plug-in hybrids (PHEVs), and hybrids (HEVs) also grew, up 34.6%, and 46.4% respectively. Volumes for petrol and diesel cars, meanwhile, grew by 4% to 1,065,448, and 2.3% to 704,204 units respectively.

Diesel, therefore, is still in demand. While registrations of new units are struggling, likely due to higher tax rates and the shift from diesel to BEVs in fleets, drivers still want the technology, meaning garages have an opportunity when it comes to diesel servicing, DPF cleaning and other related repairs. Supply of diesel vehicles into the UK used-car market will inevitably slow as registrations dry up, meaning a large number of diesels on the country’s roads will be older, and in need of aftermarket aid.

Ford Fiesta still popular

Superminis remained the most popular vehicle type, rising by 5.8% to 607,484 units and accounting for 32.3% of transactions. Rounding off the top three vehicle types were lower medium and dual-purpose cars, both rising by 7.1% to make up 26.8% and 14.9% of the market.

Combined, the three segments account for almost three quarters (73.9%) of the UK used-car market Q3. At the other end of the scale, sports and luxury saloons were the only segments to see declines, falling 1.8% and 2.5% respectively.

The Ford Fiesta continued to lead the UK used-car market, with 79,756 transactions, comfortably ahead of the Vauxhall Corsa (61,290 units). With Ford ending production of the Fiesta earlier this year, the figures show that the car remains popular with buyers, and will likely live on for some years to come.

Ford and Vauxhall dominated the top five, with the Focus in fourth place (58,431 transactions) and the Astra in fifth (41,898 sales). In third was the Volkswagen Golf, which achieved 58,928 sales, just ahead of the Ford Focus.

Black remained the most popular used car colour for the 11th consecutive quarter, equating to 21.3% of sales. The top five remain the same as Q3 2022, with grey taking second place and seeing above average gains,growing 9.8% to increase market share to 17.1%. Blue held strong in third place, silver, which once firmly held the top position, was fourth and white placed in fifth.

Opportunities for garages

Reflecting on the SMMT numbers on the UK used-car market, Andy Hamilton, CEO at LKQ Euro Car Parts, commented: “A growing second-hand market is good news for independent garages. EVs in particular are becoming increasingly accessible for motorists looking to switch. There has been a lot of talk about the potential impact of the ban on new ICE vehicles being pushed back, but today we can see that demand for EVs remains strong, as drivers look to take advantage of lower running costs and other in-life benefits.

“Stronger political will is needed if we are going to maintain this momentum. Drivers of used EVs should not be paying over the odds to service and repair them in the dealerships, so it is vital that independent garages can do the work. Garage owners need support with the cost of retooling and upskilling staff, and a willingness from OEMs to collaborate – not just on access to RMI data and coded parts, but also when it comes to refurbishing and repairing key components, to maximise the lifespan of an EV and realise the sustainability benefits fully.

“More widely, OEMs need support so they can keep feeding the market with new vehicles, and so that the oldest, most polluting vehicles can continue to drop out of the bottom. And it goes without saying that as a minimum, the rollout of charging infrastructure must keep pace with EV adoption for the technology to be viable at scale.”

You must be logged in to post a comment.