The UK’s used car market has grown for the sixth-consecutive quarter, as drivers continue to hold on to their vehicles in the wake of a new-car market slowdown.

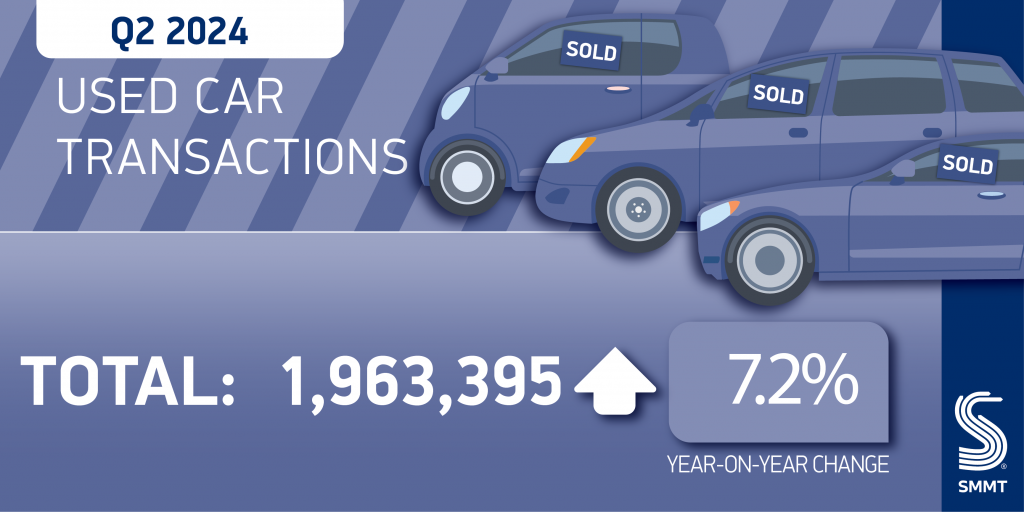

The latest figures, released by the SMMT, show a 7.2% increase in transactions between April and June, compared to the same period last year. A total of 1,963,395 passenger cars changed hands, a 131,128-unit increase.

Sustained growth in the new-car market has increased supply into the UK’s used-car market over the last few months, with a 24th-consecutive month of growth in July. However, the quarterly used-car figures coincide with a slowdown in new-car sales, when growth did not exceed 2% in a month.

Therefore, buyers are continuing to show confidence in the used-car market, meaning more potential work for the independent aftermarket, as older vehicles, with no ties to franchised dealers, continue to run on the UK’s roads.

Improvements in the used-car market

Transactions have risen every month of the year in 2024, with figures in the first half up by 6.8% compared with the period January to June last year. This is the best growth in a first half since 2016, and the best first half of a year since 2019.

In the year-to-date, the used-car market is now just 3% below pre-COVID-19 levels. However, with a car parc that is increasing, and continuing to age, there are many more vehicles on the roads, and many more drivers in charge of older models, more likely to require servicing.

“It is encouraging to see the used car market continue its recovery, with choice and affordability rejuvenated by the new car sector’s sustained run of growth,” commented SMMT Chief Executive Mike Hawes.

BEVs continue to rise

An increasing number of buyers are turning to the used-car market to search for and purchase a battery-electric vehicle (BEV). However, while transactions have increased, the number of all-electric models changing hands remains low, as does their market share.

A total of 46,773 BEVs changed hands in the second quarter, an increase of 52.6% on the same period last year. This also gave the technology a record market share, of 2.4%, up from the 1.7% hold recorded a year ago. Although these figures are impressive in terms of growth, they are low compared to other powertrains.

However, this is unlikely to be down to a lack of popularity, and more likely down to lack of supply. The new-BEV market has been growing for the last four years, as more and more carmakers invest in the technology and launch new all-electric models.

However, their numbers remains a small fraction of the overall UK car parc, which means there is less supply into the used-car market. While there are many petrol and diesel models over 10-years-old, the BEV market is still fledgling.

In fact, in the first half of 2024, there were 88,278 used-BEV transactions, up 55.1% year-on-year. If the regular three-year new-to-used rule is observed with owners and fleets renewing their vehicles after three years, or prior to their first MOT, then looking back at 2021 figures, a total of 73,893 new BEVs were sold in the first half. Therefore, the used-car market trajectory is still on track, and BEV transactions will likely increase in the months and years to come.

This is important for the aftermarket to note. While figures may seem low, it is purely down to supply, and a waiting game for buyers who want to go electric, but want a decent model at an affordable price, and they will need an independent garage who they can trust to service that vehicle. There is still time to train in EV maintenance, but the clock is ticking.

Hybrid highs

Transactions of full-hybrids (HEVs) increased by 43.6% in the quarter, with 78,782 units changing hands. This means that between January and June, a total of 153,284 units were sold to second-hand buyers, up 49.1%.

The hybrid market has been the fastest-growing new-car market in the UK for some time, and this is reflected in the used-car market figures. While petrol and diesel lead the way, thanks to their establishment, and BEVs are coming up fast, there is an appetite for hybrid models.

However, there is also a large segment of the market, including public-transport services, that hold on to hybrid models for longer, impacting supplies to the market, but increasing the need for servicing.

Meanwhile, plug-in hybrids (PHEVs) saw 21,580 units sold in the second quarter of the year, up by 25.2%. This powertrain has struggled in the new-car market for recent years, affecting supply into the used-car market. However, with sales of new models up so far in 2024, this may pave the way for growth in the years to come.

Finally, petrol- and diesel-powered cars still accounted for 92.4% of all vehicles, down from 94.3% last year. Petrol remained the most popular fuel type, up 9.2%, while diesel fell by 1.2%.

You must be logged in to post a comment.