Recovery in the UK’s new-car market continues, with SMMT November registrations data showing growth last month.

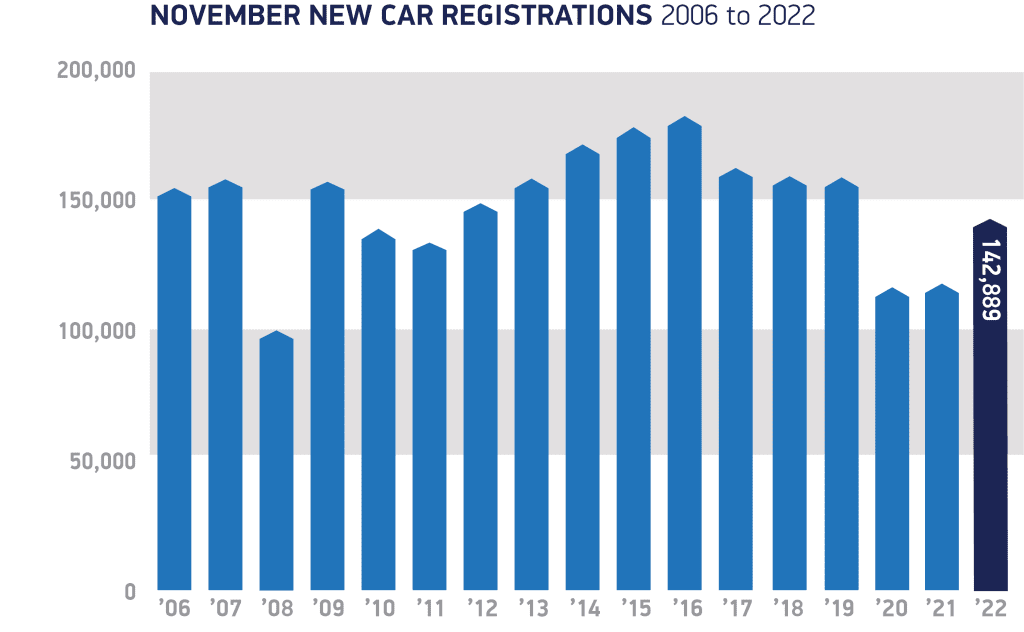

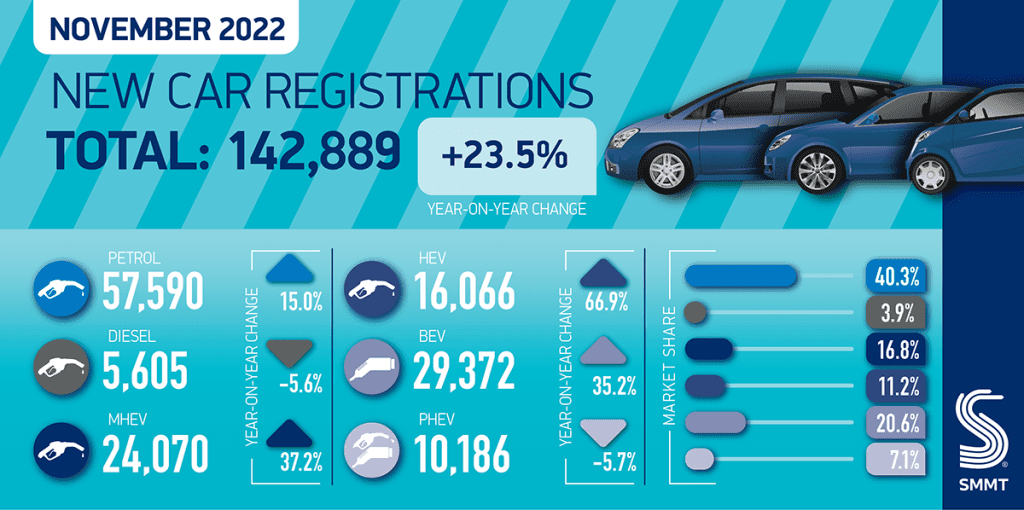

Despite continuing supply issues, the market grew 23.5% to 142,889 units, the SMMT November registrations figures show. This marks the fourth consecutive month of year-on-year increases, and the best November figures since 2019.

However, while this may seem encouraging, the numbers were still 8.8% lower on 2019, and even though recovery is expected into 2023, numbers will likely remain below pre-pandemic levels for some time, the industry body warns.

The recovery was driven by company car and electric vehicle (EV) deliveries. This in itself highlights that rather than the industry doing better than it had earlier this year, it is simply catching up with itself. Due to a shortage of semiconductors, orders of new vehicles are taking longer to fulfil. As a registration only counts when the vehicle is delivered, and not when it is sold, the conclusion is that many sales were made at a time when carmakers could not keep pace, and now supplies are improving, models are finally arriving with customers.

Yet with ongoing supply issues still causing delivery delays, and the cost-of-living crisis squeezing budgets, it is unlikely that the new-car market will return to the highs of the pre-COVID era, which even then was in decline.

The SMMT November registrations data shows that registrations by large fleets helped boost the market last month, with this sector up 45.4% compared with a year ago. This will likely help the used-car market, which draws most of its supply from companies selling on their older fleet cars.

Demand from private buyers also grew, albeit by a more modest 2.7%. Business registrations more than doubled, meanwhile, up 112.2%, but remain a small fraction of the overall market.

EVs shine in SMMT November registrations figures

Newly registered battery-electric vehicles (BEVs) showed a large increase in the market, up 35.2% in November, representing more than one in five cars through their market share (20.6%). This is the largest monthly market share of BEVs this year. Yet plug-in hybrid (PHEV) registrations fell by 5.7%, making up 7.1% of the market.

As a result, some 39,558 new plug-ins were registered, representing more than one in four (27.7%) new cars joining UK roads in November.

Hybrid electric vehicles (HEVs), meanwhile, rose by 66.9% to 11.2% of the market, which according to the SMMT November registrations information is particularly by fleet operators looking for flexibility and emissions reductions. Petrol remained the top choice for drivers, with 75,519 registrations, up 20.9%. Diesel also grew its registrations, albeit by 628 units, a 5.6% rise. However, Diesel still remains the fourth most popular choice, with a market share of just 8.2%.

The two most in-demand segments, supermini and lower-medium vehicles, grew by 21.5% and 20.5% respectively last month, SMMT registrations data shows, while dual-purpose vehicles increased 21.8%. There was a significant growth in the luxury saloon and multi-purpose vehicles, up 87.3% and 288.6%, however these figures started from a small base in the SMMT November registration data.

Growth incoming for the economy

The car sector is set to deliver an additional £8 billion for the UK economy in 2023, with an anticipated 15.4% market growth. Much of this will likely be through zero-emission vehicles as the industry pushes to make its net-zero targets. Yet further acceleration on these aims requires forward-thinking and collaboration from all stakeholders, according to the SMMT.

Measures that boost motorists’ confidence in EVs, including a fiscal framework that encourages EV adoption and targets to speed up the provision of charging infrastructure, will help to ensure uptake is in line with the UK’s green goals, particularly as the ambitious Zero-Emission Vehicle Mandate comes into effect.

“Recovery for Britain’s new car market is back within our grasp, energised by electrified vehicles and the sector’s resilience in the face of supply and economic challenges,” commented SMMT Chief Executive Mike Hawes. “As the sector looks to ensure that growth is sustainable for the long term, urgent measures are required – not least a fair approach to driving EV adoption that recognises these vehicles remain more expensive, and measures to compel investment in a charging network that is built ahead of need. By doing so we can encourage consumer appetite across the country and accelerate the UK’s journey to net-zero.”

You must be logged in to post a comment.