As the UK’s new car market enjoys a strong period of growth, so too does the used car sector, as supply finally starts to pick up.

Used car transactions grew by 4.1% during the second quarter of the year, with 1,832,267 units changing hands, according to the Society of Motor Manufacturers and Traders (SMMT). This equates to an additional 72,583 transactions over the same period in 2022.

The used car market is linked to the new car market, in that when the latter struggles, so too will the former. If new cars are not available, there will be no supply of used cars as drivers hold on to what they have instead of trading in. During 2022, the industry suffered with the supply of semiconductors, slowing vehicle production, and halting new-car deliveries.

The easing of supply chain disruptions has driven used car sales growth in every month so far this year and, although the Q2 market remains 9.9% below 2019 levels, its recovery continues apace.

BEVs soar in used car market

Used battery-electric vehicle (BEV) transactions grew by 81.8% in the second quarter of the year, with 30,645 units representing a market share of 1.7%. While this may not seem like a lot, it is worth remembering that the average age of a used car is three years, and new-BEV sales only started increasing at a rapid rate from 2020 onwards as new models became available.

Therefore, as new-BEV sales increase in the coming years, so too will the technology see more units enter the used car market. This means the BEV car parc will also increase as years go on, making training in electric vehicle (EV) maintenance all the more crucial to ensure technicians can service every model that enters a workshop.

Double-digit growth also continued for plug-in hybrids (PHEVs) and hybrids (HEVs), up 11.4% to 18,437 units and 29.5% to 53,634 units respectively. The rising proportion of electrified vehicles meant that market share for conventionally powered cars marginally fell to 94.3% from 95.7% last year, even though volumes of petrol and diesel cars saw growth of 2.5% and 2.8% respectively.

“It is great to see a recharged new car sector supporting demand for used cars and helping more people to get behind the wheel of an electric vehicle,” Stated SMMT chief executive Mike Hawes. “Meeting the undoubted appetite for pre-owned EVs will depend on sustaining a buoyant new car market and on the provision of accessible, reliable charging infrastructure powered by affordable, green energy.

“This, in turn, will allow more people to drive zero at a price point suited to them, helping accelerate delivery of our environmental goals.”

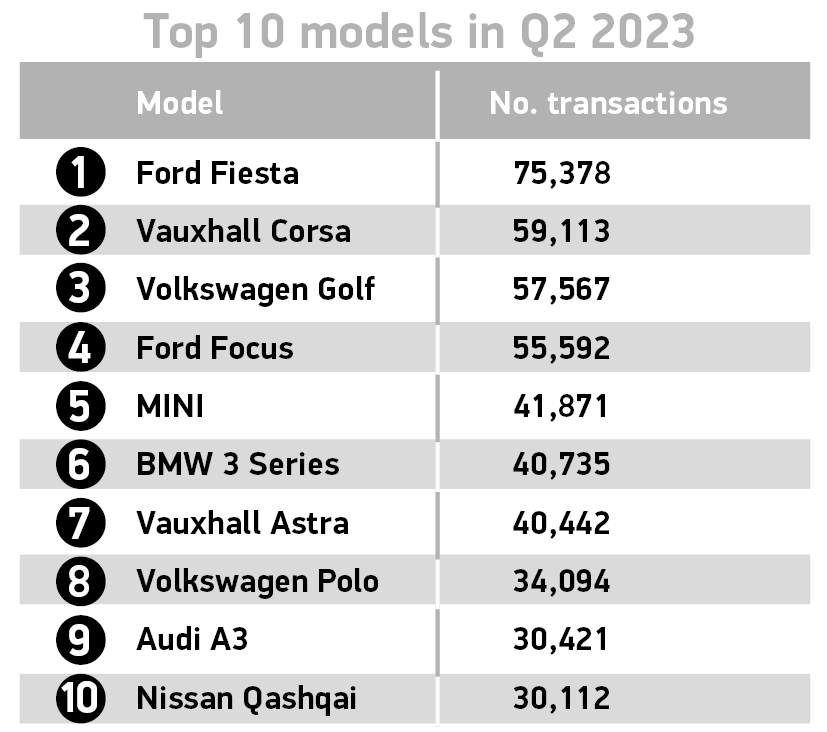

Fiesta shines as production ends

Despite Ford ending production of the Fiesta after 47 years, the car remains popular on the UK market, and led the Q2 used car figures by some way, with 75,378 transactions, ahead of the second-placed Vauxhall Corsa by 16,265 units. The Volkswagen Golf took third spot, with the Ford Focus in fourth, and the Mini in fifth.

Superminis remained the best-selling used vehicle type, making up 31.5% of transactions and growing by 4.4% to 576,980 units. This was followed by lower medium, accounting for 26.5% of the market, while dual purpose cars rounded off the top three with a 15.1% share.

Black retained its position as the most popular colour choice for the 10th quarter in a row, representing more than one in five (21.3%) transactions. It was followed by grey and blue in second and third places with respective 16.9% and 16.3% market shares.

Car parc continues to age

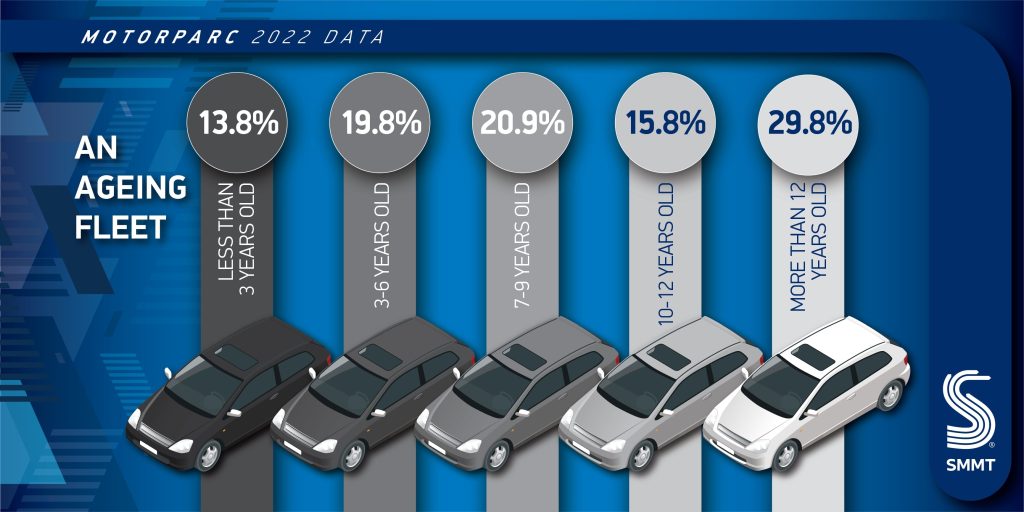

The improvements in the used car market shows that UK drivers are still interested in older vehicles, despite the improvements in registrations this year.

This is also reflected in the UK car parc figures. The number of cars in use on UK roads in 2022 rose by 124,393 units to a total of 35,148,045. This has returned the number of cars on the road to levels last seen in 2019, while the overall number of vehicles (including vans, HGVs and buses) has risen to a record 40,723,974 units as supply shortages begin to ease and scrappage levels decline.

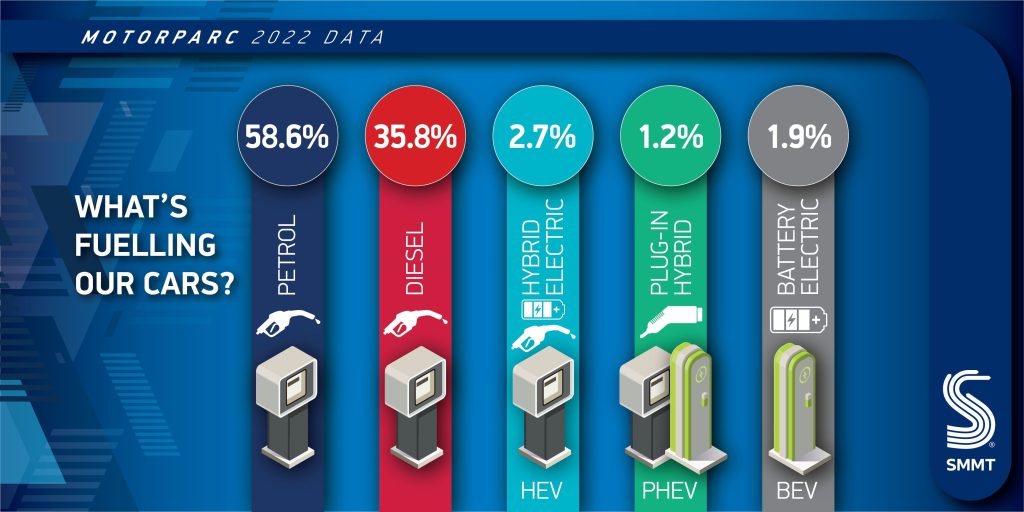

Petrol is still the most popular fuel type, with 58.6% of cars on the roads, followed by diesel which, despite declining sales, remains with over a third of the market (35.8%). Therefore, 94.4% of cars currently in use have an internal combustion engine, with EVs holding a smaller percentage. This is to be expected, as hybrid, PHEV and BEV technologies are still relatively new, but still means that almost two million cars on UK roads have an electric element.

Despite the overall increase in vehicles on the road, average car and van CO2 emissions have fallen by 1.6%, driven by the influx of new lower and zero-emission models to the UK car parc. One in 32 cars driving in Britain is a PHEV or BEV, amounting to 1,089,241 vehicles – a rise of more than half over the last year, to reach 3.1% of the parc.

The UK car parc is also ageing, with 29.8% of vehicles over 12-years of age. This has increased by 1.1% on last year’s figures. As expected, thanks to the supply-chain crisis and falling demand since the COVID-19 pandemic began, cars less than three-years-old have dropped to 13.8% of the parc. Drivers are, therefore, holding onto their cars for longer, making servicing more important than ever.

“After two tough years, Britain is on the road to recovery with the first growth in car ownership since the pandemic,” added Hawes. “Better still, we are driving Britain towards a net-zero future with more than a million zero-emission vehicles now on the road and cutting carbon.

“With exciting new technologies and models fuelling our appetite to get back behind the wheel, now is the time to commit to greater investment in infrastructure and incentives, to speed up a switch to carbon-free mobility that is accessible to all.”

You must be logged in to post a comment.